Page Contents

How to file GST REG-18 Reply to GST Cancellation Show Cause Notice?

Form GST Reg-18 is filed on the GST portal as a response to the show-cause notice issued under GST REG-17. A registered person is required to file a response, in case of failure in filing GST REG-18. The GST Department will not proceed with further action which is the cancellation of GST Registration.

Read GST Cancellation Notice GST REG-17

The GST REG-18 is filed online, the same way clarification is filed in GST Registration. In this blog post, we will learn about how to file GST REG-18 and also view a copy of it as provided by the department.

Time limit to file GST REG-18

The time limit to file GST REG-18 is mentioned on the GST REG-17 which is seven working days from the service of notice. In case, any other time limit is mentioned due to covid or other circumstances, that time period will be considered.

GST REG-18 PDF Format: Reply to Show Cause Notice issued for cancellation of registration

The GST REG-18 format would have seven fields which are listed below.

- Reference Number and Date of issue of Notice

- GSTIN for which response is getting filed.

- Legal Name of Business

- Trade Name as entered at the time of registration

- Reply to the Notice

- List of documents uploaded as supporting.

- Verification by the Authorized Signatory

Download GST REG-18 PDF format

Steps to file GST REG-18 online on GST Portal

Step 1: The first step is to log in to the GST Portal.

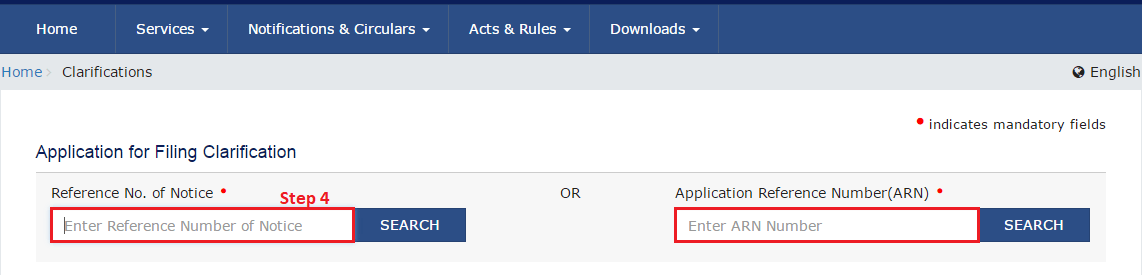

Step 2: After logging on to the GST portal, go to Services > Registration > Application for Filing Clarifications.

Step 3: Enter the Application Reference Number (ARN) or Show Cause Notice Reference Number. The SCN reference number can be found on the top of GST REG-17(Notice).

Step 4: Now click on “Search Button” and GST REG-18 for which a response needs to be submitted will display on the page.

Step 5: Write the reply to the notice and attach the well-drafted response in the attachment tab.

Step 6: File the response with DSC or EVC code.

Now, the reply is filed. If the GST officer accepts the response and is satisfied. The proceedings will be dropped. However, the GST officer can cancel the GST Registration also, if he is not satisfied and issue a cancellation order.

Order for Cancellation of GST Registration- GST REG-19

In case the GST officer believes, the GST Registration needs to be canceled Suo moto or the registered person himself applied for cancellation. Also, when the response is filed under GST REG-18 which is not accepted by the GST officer. An order would be passed for cancellation of GST Registration that is GST REG-19. The order is mandatorily received in case of cancellation.

The GST REG-19 order would have the following columns.

- Reasons for cancellation of GST Registration

- The effective date of cancellation

- Amount to be payable on account of cancellation of GST Registration. Further, subdivided into Tax, Interest, Penalty, Others.

- Payment of amount before the due date.

GST REG-19 Format PDF

FORM GST REG-19

Reference No. – Date

To

Name

Address

GSTIN / UIN

Application Reference No. (ARN) Date

Order for Cancellation of Registration

This has reference to your reply dated —- in response to the notice to show cause dated —–.

– Whereas no reply to notice to show cause has been submitted; or

– Whereas on the day fixed for hearing you did not appear; or

– Whereas the undersigned has examined your reply and submissions made at the time of the hearing,

and is of the opinion that your registration is liable to be canceled for the following reason(s).

1.

2.

The effective date of cancellation of your registration is <<DD/MM/YYYY >>.

Determination of amount payable pursuant to cancellation:

Accordingly, the amount payable by you and the computation and basis thereof is as follows:

The amounts determined as being payable above are without prejudice to any amount that may be

found to be payable to you on submission of final return furnished by you.

You are required to pay the following amounts on or before —— (date) failing which the amount

will be recovered in accordance with the provisions of the Act and rules made thereunder.

| Head | Central Tax | State Tax | UT tax | Integrated Tax | Cess |

| Tax | |||||

| Interest | |||||

| Penalty | |||||

| Others |

Total

Place:

Date: Signature

< Name of the Officer>

Designation

Jurisdiction

Download GST REG-19 PDF format

What to do after issue of GST REG-19?

The GST Registration has been canceled. The registered person can neither file subsequent returns nor issue a tax invoice. In case, demand is mentioned in the order. It needs to be paid within the time mentioned. Also, the effective date of cancellation is mentioned in the notice which is quite important for returns and other perspectives.

GST REG-19 is also issued when the GST Officer is not satisfied with the response filed under GST REG-18. The supporting attached and the reply furnished failed to change his opinion of cancellation of GST Registration. The reason for canceling the registration was provided under GST REG-17 to the person.

Now, within 30 days a registered person who is aggrieved can file for revocation of cancellation of GST Registration.

GST REG-20 Dropping of Proceedings of Cancellation of GST Registration

In case the GST Officer accepts the response filed under GST REG-18, the GST Officer would issue GST REG-20 which is an order for dropping of proceedings for cancellation of GST Registration. The order would be mandatorily received.

The status of GST Registration will become “Active” now.

GST REG-20 Format PDF

FORM GST REG-209

[See rule 22(4)]

Reference No. – Date –

To

Name

Address

GSTIN/UIN

Show Cause Notice No. Date

Order for dropping the proceedings for cancellation of registration

This has reference to your reply filed vide ARN ———- dated —– in response

to the show cause notice referred to above. Upon consideration of your reply

and/or submissions made during the hearing, the proceedings initiated for

cancellation of registration stands vacated for the following reasons:

OR

The above-referred show cause notice was issued for contravention of the

provisions of clause (b) or clause (c) of sub-section (2) of section 29 of the

Central Goods Services Tax Act, 2017. As you have filed all the pending

returns which were due on the date of issue of the aforesaid notice, and have

made full payment of tax along with applicable interest and late fee, the

proceedings initiated for cancellation of registration are hereby dropped.

Signature

< Name of the Officer>

Designation

Jurisdiction

Download GST REG-20 PDF format

What to do after issue of GST REG-20?

Once GST REG-20 has been received, the proceedings initiated under GST REG-17 are dropped. The reason mentioned under GST REG-17 has received an adequate response under GST REG-18 to which the GST Officer is satisfied.

The registration status is active and the registered person can issue tax invoice and file subsequent GST Returns.