Page Contents

Validity of GST registration certificate, Its Contents & Verification

After obtaining GST Registration, we need to download the GST Registration certificate. The first question that comes to our mind is What is the validity of the GST Registration Certificate or whether any renewal would be required. What are the contents of the GST Registration certificate and how to verify the accuracy? We will discuss the validity of GST registration for each type of person in GST and extension if possible. First answering some basic questions.

GST Registration Certificate is granted in the Form GST REG-06. The government does not issue any kind of physical certificate. The certificate can be download after logging in to the GST portal. The most simple way to download the certificate is to go to Profile Tab on the top right corner and on the bottom left you will find the GST Registration certificate.

Read: How to login into GST Portal for the first time?

What is the validity of the GST registration certificate?

For Normal Persons who take GST registration, There is no time limit for the expiration of the GST Certificate. It is valid till GST is not cancelled or Surrendered. GST Registration may be cancelled voluntarily by filling GST REG-16 or his registration can be cancelled by the GST Officer. GST officers mostly cancel the registration in case of non-filling of GST returns or Principal Place of business found to be non-existent or any fake document attached.

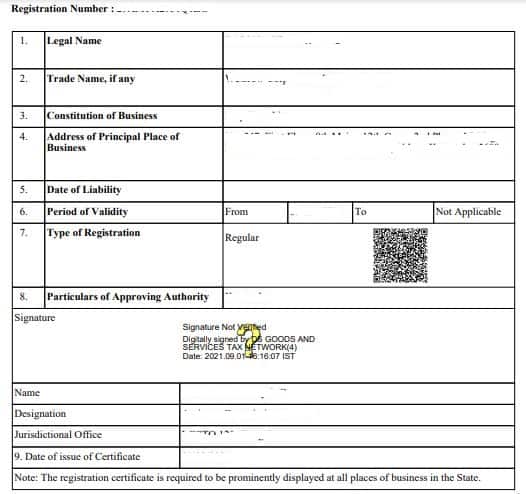

When you will check the GST certificate, there will be a column “Period of Validity” From ‘GRANT DATE’ To ‘NOT APPLICABLE’ which we will see below.

However, GST registration certificate validity for Casual Taxable Persons and Non-Resident Taxable Persons is different. The certificate of registration will be valid for ninety days or the time period specified in Part B of GST REG-01 whichever is earlier. The casual taxable person can only undertake supplies of goods after granting a certificate of registration.

Read: Casual Taxable Person Under GST

Display of GST Registration Certificate

Similarly, like GST Display Board containing Trade Name and GSTIN. Rule 18 of the Central Goods and Service Tax (CGST) Rules, 2017 states that every registered person in GST is required to display the GST registration certificate in a prominent site at the principal place of business and also at every additional place of business. Any Failure would attract a penalty of Rs. 25,000.

It is always mentioned on the GST Registration at the bottom of the first page which can be seen below in the contents.

In case of any amendment in GST registration, a new updated certificate can be downloaded once the amendment is accepted.

Contents & Sample GST Registration Certificate

The first page of the GST registration certificate would contain the following.

- Legal Name of Business mentioned on the PAN Number

- Trade Name if provided

- Constitution of Business Like Partnership Firm, Proprietorship, Company or LLP.

- Address of Principal Place of Business

- Date of Liability would be the date when the taxpayer became liable to register in GST.

- Period of Validity beginning from Grant Date to Not applicable for Normal taxpayers.

- Type of Registration

- Particulars of Approving Authority would be the details of GST official who granted GST registration like Name, Designation and his place of Sitting.

It is specifically mentioned to display GST registration certificates at all places of business in the state.

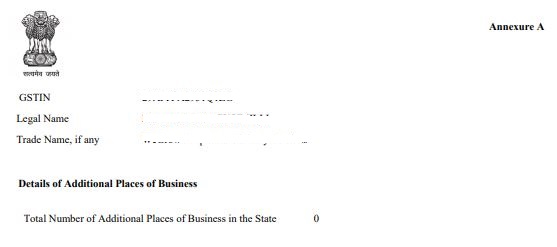

The second page or Annexure A of the GST registration certificate displays the following.

- Details of Additional Place of Business if added while obtaining GST registration or later on added via amendment in fields.

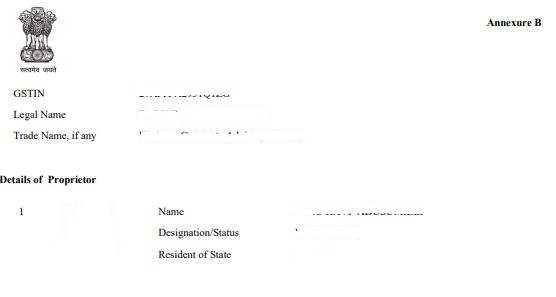

The third page or Annexure B of the GST Registration certificate displays the following.

- Passport Size Photo of Promotor

- Name

- Designation Status

- A resident of State

Verification of GST registration Certificate

Now, we would perform few checks to find out whether the GST registration certificate is valid or is an edited version. Let’s go step by step.

Step 1: Check GSTIN number, GST Number should have the following format and should be 15 digits.

- The first two digits are state codes like 06 for Haryana or 07 for Delhi respectively, every state has its own code.

- The next 10 characters consist of the PAN number of the registered person. If you have PAN available, you can check the same.

- The next is the entity number of the Same PAN.

- The fourteenth character is Z by default.

- The last and fifteenth can be a character or an Alphabet which is randomly selected.

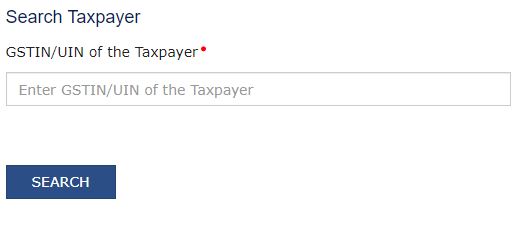

Step 2: Checking the same on GST Portal. Now, we are going to verify the Trade Name on the GST portal. Move on to this link of the GST portal Search Taxpayer.

We need to copy the GST Number and enter it in the form above and then click on the “Search Button”. Once done it shows the trade name.

Step 3: The next step would be to come back on GST Registration Certificate and look at the Trade Name and Legal Name. Are they the same? If they are the same GST registration is valid, in case the person wants to perform more checks, move on to the next step.

Step 4: These are the least important checks, however can be done.

- Check Constitution of Business whether it’s a Partnership, Proprietorship or a company dealing with.

- Always Check Additional Place of Business, this can give you an idea of whether the person had added the place of transferring goods and services as an additional place or not.

- Validity of GST registration certificate can be checked for Casual taxable Persons and Non-Resident taxable persons.

- Also, the Details of the proprietor in Annexure B would give us a clear idea to whom such GST Registration belongs. Whether any other person is using the GST Registration for his own benefit.

There were cases in the limelight when GST registrations were obtained in the name of innocent people and used for creating fake firms. This caused huge losses to the government.