Page Contents

What are the main topics to be learned in CA Articleship?

What is the work done in CA Articleship? Can you share your Articleship experience? What is your stipend? What is the best field to do CA Articleship?

Often these questions stuck in our minds when we are going to start our CA Articleship. CA Articleship is the backbone of the Chartered Accountancy course. One should never opt for dummy practical training.

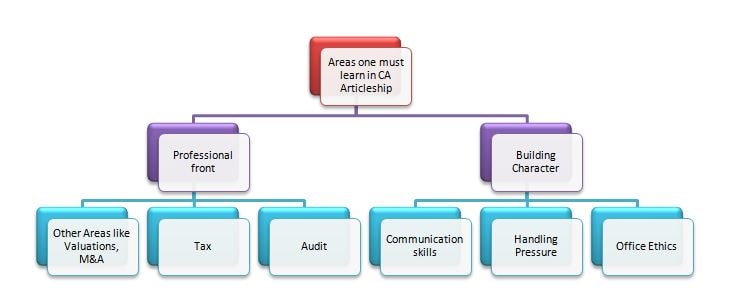

The above chart, clearly, depicts what can be learned during CA Practical training? From a professional front to building character for life training builds our personality. Diving deeper into these topics we will discuss them all one by one.

What can you learn on the professional front in CA Articleship?

Every firm has its own domain area in which it operates. Some of them would have large clients in audit while some have clients related to tax. Before commencing Articleship one should always research about firm core domain areas.

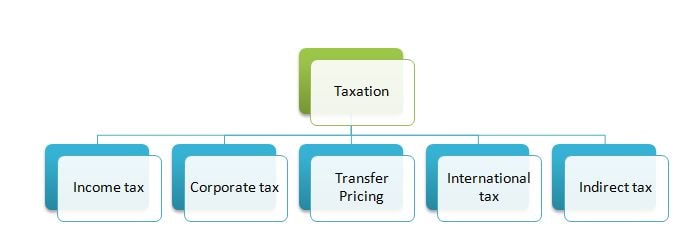

Taxation

The field of taxation is further divided into Income tax, corporate tax, transfer pricing, international tax, and indirect tax

Income Tax

If one has to start practice immediately after clearing CA final exams then one must have practical knowledge of “Income tax” and should be able to handle “litigations”. File as many ITR’s as you can during the training period.

Prepare opinions, read case laws, make replies, and if you get any chance to interact with an income tax officer, then you should not miss that.

Indirect Tax

GST is new in India and many companies require GST consultancy. So, prepare opinions, try to fill all types of returns, learn about the input tax credit, and stay updated with this topic. If your firm has good clients GST then this is an opportunity for you to learn something new daily.

For Instance: Recently, the government has launched GST 9 and 9C, and look at what can you learn in GST AUDIT.

Transfer Pricing /Corporate Tax/International Tax

The departments of transfer pricing, corporate tax, and international tax are not observed in medium-sized firms. Usually, Big 4 companies have clients related to transfer pricing. These areas are not traditional and if you got an opportunity to learn in these areas then you must strike at it.

Prepare as many reports of “Transfer pricing” and learn about how to calculate arm length price. Also, learn about domestic transfer pricing applicability. This will help in your CA Final exams also.

Checkout DTAA provisions of India with other countries and learn how to fill Form 15CA/CB. Most of the international clients require 15CA/CB services to remit money outside India.

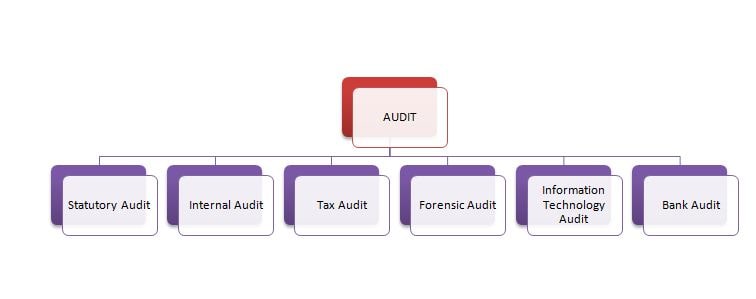

AUDITING

Statutory Audit

Most of the firms have clients of Statutory Audit. Statutory Audit is the most interesting audit as you have to check whether financial statements present a true and fair view. However, a statutory audit is a complete examination of the company’s trial balance.

Learn to prepare TDS reconciliations, GST reconciliations, and Bank reconciliations. Also, learn how to prepare a balance sheet from scratch.

Internal Audit

Internal audit is basically checking out the internal controls and understanding the various processes of the company.

For example, You can learn about the Procurement process from beginning to end.

A good internal auditor always possesses a strong hand on Microsoft excel.

Check out our blog on“Audit of Purchase Department”.

Tax audit

Learn how to fill FORM 3CD. Filling FORM 3CD and attached enclosures requires a deeper knowledge of the direct tax system in India. This is one of the interesting audits.

Bank Audit

If you ever get an opportunity to do a “Bank Audit”, then don’t miss it at any cost. You will surely understand the banking system in India and how to find Nonperforming assets

Forensic Audit and Information Technology Audit

These departments in any Big 4 company are closed for CA Articles.

Valuations field

Preparing due diligence reports and calculating the value of equity shares is what this department revolves. So, you will learn about all these things within 9 months.

How CA Articleship builds character?

Your training in the CA course determines your character for life. You are giving your precious three years to something. Make sure, it’s worth it.

You will learn how to communicate with clients whether formally or informally, dealing with the pressure during deadlines. The way you present yourself from polishing shoes to setting your hairs, one will definitely learn about all these things during CA Articleship.

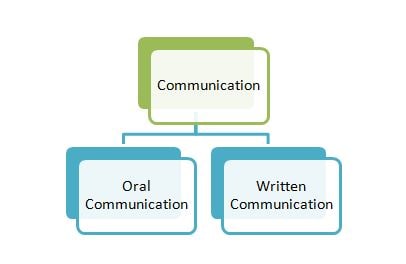

Communication

Oral Communication

Communication-the human connection is the key to personal and career success. –Paul J Meyer

During audits, you will definitely communicate with the client or client personnel like the Accounts Manager. The way you interact with them will illustrate your values and your knowledge.

Develop strong bonds with the people you meet during articles and connect with them on Linkedin. They will surely help you in the future.

Written Communication

Learn how to formally communicate with the client through E-mails or any messaging system.

Although, writing reports and documentation of processes in Internal Audits is not a part of written communication. Still, one must know how to write a report or draft any reply to the Income-tax department.

Handling Pressure

Handling pressure and maintaining patience during stressful hours is an art. If you learned this, then the CA course is too easy for you.

During Income tax returns or Statutory Audit, there will be tremendous pressure in the office. You need to learn how to handle pressure and meet deadlines.

Office Ethics

- How you maintain your desk?

- Are you supporting them during stressful hours?

- How you maintain your workplace environment?

- How you interact with your colleagues?

- At what time you reach the office?

You might be thinking how can these things affect our personality? An unclean desk will show how you keep your things at your home. These things reflect our family values. One must learn office ethics

Being punctual is one of the moral values and it portrays how dedicated you are to your work.

Thanks! Hope you liked our blog on “Topics to be learned in CA Articleship”