Page Contents

Guide on Revocation of Cancellation of GST Registration

Revocation of cancellation of GST Registration deals about getting back GST Registration once the order of cancellation under GST REG-19 is passed. First, the officer issues GST REG-17 which is a show-cause notice, then we file a response under GST REG-18, then he issues an order of cancellation under GST REG-19 or drops the proceedings under GST REG-20.

Now, in this blog post, we are going to move forward but first, you start further reading. Acquiring knowledge about these things would help.

- Reason for Suo Moto GST Cancellation

- Suspension of GST Registration

- GST REG-17 Show Cause Notice Download

- GST REG-18 How to reply and GST REG-19 & 20

Once, you have read you might have got an understanding of how things are going to evolve further.

Steps to file Revocation of GST Application GST REG-21 on GST Portal

A taxpayer whose registration has been canceled by the GST officers Suo moto can apply for revocation under GST. The application needs to be filed within 30 days of receiving the notice of cancellation.

As you might have learned in reasons for Suo moto cancellation, GST Officers can cancel the GST Registration on account of non-filing of GST Returns for a continuous period of six months. To revoke the same, one needs to file all the pending returns along with late fees and interest if applicable. Then only, he should apply for revocation of GST Cancellation.

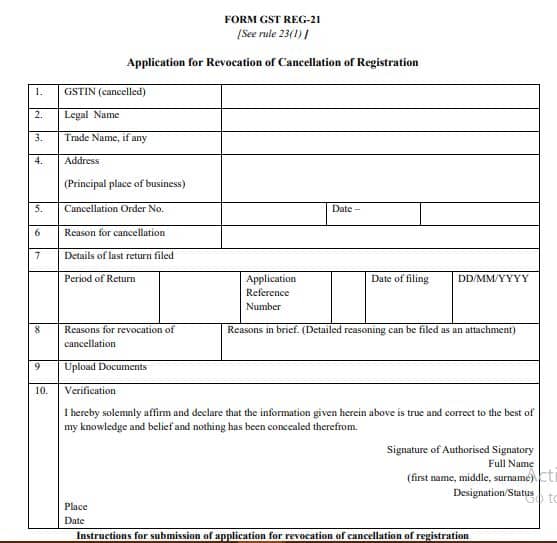

Have a look at the GST REG-21 form provided.

Step1 The first step is to login into the GST portal.

Step 2: After logging in to the GST portal, one should move towards the Services>Registration>Application for revocation of GST Registration Cancellation.

Step 3: The basic details, Address of Principal place of business, Cancellation Order Number (GST REG-19), Reasons for cancellation of GST Registration would be mentioned on the screen.

Now, one should enter the reasons for revocation of cancellation of GST Registration, attach the supporting documents, click on the verification icon, select the name of authorized signatory, enter the place of adding information and submit the application via DSC or EVC.

So, the GST REG-21 is successfully filed now and a message would be received on the provided phone number and email.

No fees are payable for revocation of cancellation of GST Registration. The status of the application can be tracked on the GST portal.

GST REG-22 Order for Revocation of Cancellation Of GST Registration

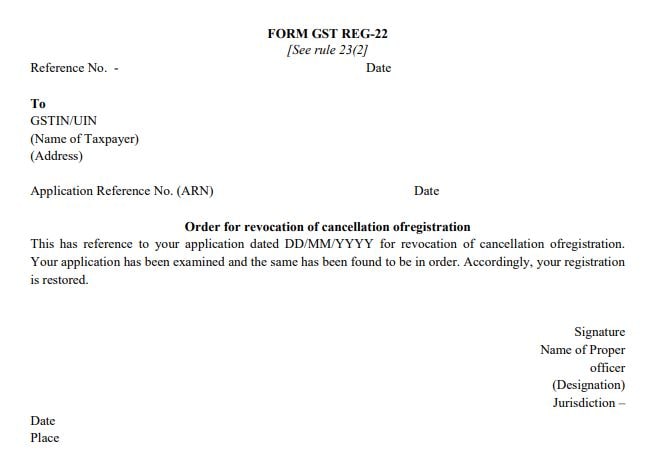

GST REG-22 is issued by the GST Officer when the revocation application filed under GST REG-21 is accepted by the GST department. It simply means, GST Cancellation has been revoked and the registered person’s GST is active now.

The registered person can now issue tax invoices and file GST Returns. GST REG-22 normally is only issued when GST REG-21 is filed within the time limit specified.

Have a look at the GST REG-22 form.

It is clearly mentioned that the GST Registration has been restored.

Now, moving forwards what if the GST Cancellation Revocation application has not been accepted by the GST Department.

GST REG-23 Notice for rejection of application for revocation of cancellation of registration

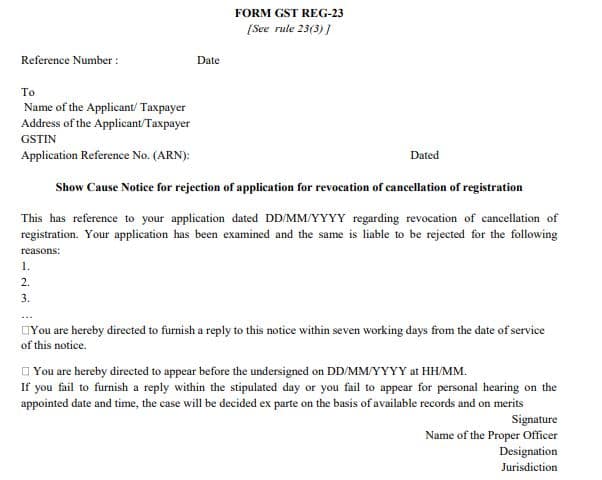

GST REG-23 is a show-cause notice issued in response to the revocation of cancellation of GST Registration. The reason for the issue of Show cause notice is that the GST Officer is not satisfied with the supporting documents and is not ready to revoke the cancellation.

Remember, GST REG-23 is different from the show cause notice issued initially for starting the cancellation proceedings.

The reason for objecting to the GST REG-21 would be mentioned on the notice. The time limit to reply to GST REG-23 is seven working days from the date of service of notice. In case, a response to the notice is not filed within the time specified. GST Officer will move forward with the records available and reject the revocation application filed under GST REG-21. The chances to revoke the cancellation will be over.

Have a look at the format of GST REG-23.

Moving forward, on how to file a response to GST REG-23

GST REG-24 Filing of Reply to the notice of rejection of application for revocation of cancellation of registration

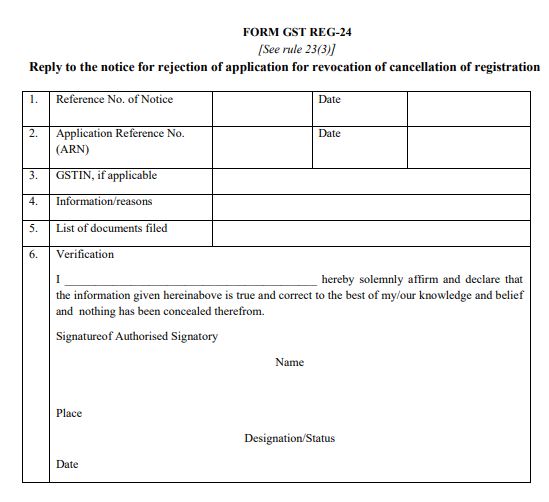

GST REG-24 is filed as a response to the notice received under GST REG-23.

The GST REG-24 contains the following columns.

- Reference Number of Notice

- Application Reference Number

- GSTIN

- Information or Reasons

- List of Documents (Supporting) attached

- Verification by the Authorized Signatory

Have a look at the extract of GST REG-24

Revocation of GST Registration Time Limit

The most important question in whole of the process of revocation of GST Registration is what is the time limit to restore GST. The time to file a revocation of GST Cancellation is within 30 days from receiving the order of cancellation.

However, the time limit has been extended for filing of revocation of application to 30th September 2021 where the due date of filing such application falls between 1st March 2020 to 31st August 2021 via CGST Circular 158/14/2021 GST on 6th September 2021. The benefit would be available irrespective of the status of the application.

Now, understand the benefit of such notification on the application.

- In case the application for revocation of cancellation is yet to be filed by the taxpayer. Then he can file applications up to 30th September 2021.

- The application has been submitted but is pending with the officer. No action needs to be taken by the officer on the validity.

- The application was filed and was rejected by the officer. The taxpayer didn’t appeal against the rejection. Then a new application can be filed before 30th September 2021.

- Appeal filed against the rejection of revocation application and is pending with the appellate authority. No action needs to be taken by the taxpayer. Appellate Authority will proceed with the appeal.

- Application rejected by the officer and appellate authority decided against the taxpayer. The taxpayer can submit a fresh application before 30th September 2021.

Further under Section 30 of CGST Act, from 1st January 2021, a new proviso allowed for extension in the due date to apply for revocation by Additional or Joint Commissioner or the Commissioner for 30 days. Now, this provision created confusion amongst the taxpayer which CBIC clarified.

- If the time limit to apply for revocation of 30 days filed between 1st March 2020 to 31st March 2021. The last date for revocation application is 30th September 2021.

- Where the time period of revocation application (30 days) since the cancellation is not over as on 1st January 2021 or where the registration has been canceled after 1st January 2021. Then, the three situations will arise.

| Situation | Last date for revocation application |

| 90 days time period is over by 31st August 2021 | 30th September 2021 |

| 60 days time period has elapsed by 31st August 2021 | 30th September 2021 plus another 30 days only after commissioner approval |

| 30 days time period has elapsed by 31st August 2021. | 30th September 2021 plus another 30 days approved by Joint or Additional Commissioner. Further, 30 days in total if approved by the commissioner. |

The extension is only available on account of the non-filing of returns.