Page Contents

New functions on GST portal in the year 2021

Since the beginning of this year, the 2021 GST portal had seen many upgrades mostly regarding auto-population of data to avoid any mismatch in GST return. We have discussed them in detail as per the GST document issued by the portal.

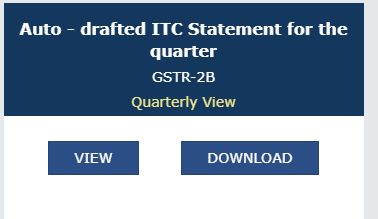

Auto Generation of Form GSTR-2B, for the taxpayers under QRMP scheme

- Taxpayers can now view and download their system-generated Quarterly Form GSTR-2B, by clicking on the Auto-drafted ITC statement for the quarter by selecting the last month of the quarter (M3). Under the QRMP scheme, the GSTR-2B would be generated for the quarter in the last month only after GSTR-1 of the third month.

- Form GSTR-2B would contain details of the Invoice Furnishing Facility filed for the first two months and GSTR-1 for the last month. Form GSTR 2B has two sections of ITC i.e. ITC available and ITC not available (which flows from the supplier’s filed IFF & Form GSTR-1, imports, etc.). It also contains the tax liability of the taxpayer (which flows from the taxpayer’s own filed IFF & Form GSTR-1).

- The default view of Form GSTR-2B is quarterly. However, to view Form GSTR-2B of a particular month (M1, M2 orM3), the taxpayer has an option to select the appropriate month, from the view drop-down to view that month’s data.

Auto-population in Form GSTR-3B of ITC, for taxpayers in QRMP Scheme

- Now the Input Credit reflected in GSTR-2B and the reversals is directly auto-populated in GSTR 3B for the taxpayers under QRMP scheme and regular scheme.

- On the GSTR-3B dashboard page, an additional button ‘System computed GSTR-3B’ has also been provided, by clicking which system computed Form GSTR-3B can be downloaded in PDF format.

- Taxpayers under the QRMP scheme can edit the auto-drafted values as per their records and save the updated details in their Form GSTR-3B.

- A warning message to taxpayers in case ITC available is increased by more than 5% or ITC to be reversed is reduced even partially, by them. However, the system will not stop the filing of Form GSTR-3B in these cases. But it is advised not to do material changes to the figures.

Auto-population of liability in Form GSTR- 3B, for taxpayers under QRMP Scheme

- Liability in Table-3 (except 3.1(d)) of Form GSTR-3B, for the taxpayers under QRMP Scheme, will now be auto-populated on the basis of Filed quarterly Form GSTR-1 (of Month 3) and Filed IFF (of Month 1 & 2). The liability of table3.1 (d) is auto-populated from the filer’s Form GSTR 2B.

- Note: Data saved/ submitted in Form GSTR-1 or in IFF, will not be auto-populated as Liability, the IFF or GSTR-1 should show the status of “Filed” not submitted.

Use of Matching Offline Tool by the taxpayers under QRMP scheme

- The system-generated Form GSTR-2B JSON file can be used for matching details, as available with them in their purchase register, using the updated Matching Offline Tool.

- Taxpayers under QRMP Scheme can now navigate to Services > Returns > Returns Dashboard, select the Financial Year and Return Filing Period > SEARCH and click on the Download button on Auto – drafted ITC Statement – GSTR-2B tile to download the system generated Form GSTR-2B JSON file, for opening and matching it in the matching tool.

Generation of Form GSTR-11, based on Form GSTR-1/5

- UIN holders are required to file details of purchases (inward supplies) in their Form GSTR-11. Now their Form GSTR-11 will be generated on the basis of Form GSTR-1 & Form GSTR-5, filed by their supplier taxpayers. This will facilitate UIN holder’s in filing their refund claim.

Read about types of GST Returns from GSTR-1 to GSTR-11

Connect with us at +917701879108 and gstmentor1@gmail.com