Page Contents

How to update bank account details in GST?

In this blog, we are going to discuss “Bank Account details” in GST registration while filing the application or after obtaining GST registration. We will try to resolve all your queries, in case still, some of them are pending, you can contact us.

Before we jump upon how to add a bank account. First, understand what provisions govern the Bank Account in GST? What can happen if we don’t add Bank Account in GST? Moving forward on the provision.

Rule 10A of CGST Act, 2017

In case of bank account details are not added after obtaining GST Registration. Once the GST Registration is accepted, a provisional ID is sent on the registered email to create login credentials.

Read: How to create GST first-time login credentials?

Once login credentials are prepared, a warning sign appears to add bank bank account and Rule 10A is mentioned there.

Rule 10A deals with the requirement of furnishing bank account details under GST. The provisions of Rule 10A are applicable to the registered persons who have received GST registration Certificate under GST Reg-06 and have been granted a 15 digit GSTIN number. It simply means all registered persons are required to update their bank accounts.

Read: GST Registration Certificate GST Reg-06

Time limit to add Bank Account in GST

The eligible taxpayer is required to furnish the details of its bank account within earlier of the following dates

- 45 days from the date of the grant of the registration

- or Due date of furnishing of GST return as per section 39 of the CGST Act.

So, the registered person needs to update within 45 days which you might have seen the warning, in case you have not updated the Bank.

Is it mandatory to add a bank account in GST?

In case the bank account is not added in GST Registration. A warning sign would appear which would be like this. We have already read above that Rule 10A states that a bank account is mandatory.

So, what if we don’t update the bank account in 45 days. Then? GST portal will automatically grant a few more days. What if we still don’t update the bank account in GST?

First, the account will be frozen. The registered person will not be able to file any returns and all the features will be frozen. The only thing available will be to add bank account details.

Still, if bank account details are not added. The GST registration will be canceled.

So, it’s better to add a bank account while submitting the GST Registration application or within the proper time, if the new account needs to be opened.

How to add Bank Account details in GST Registration?

Step 1: The first step is to log in to the GST portal

Step 2: In case bank account details are not added, a popup will appear on the screen which will look like below.

A warning would be issued to the registered person to update the bank account. Now click on “File Amendment”. Here we are going to amend the “Non-Core Fields”

Step 3: The screen would appear which would be like GST Registration application when we were filing it for the first time. In case, a person wants to add a bank account while submitting the GST registration application (GST REG-01). He can start from Step 3 only.

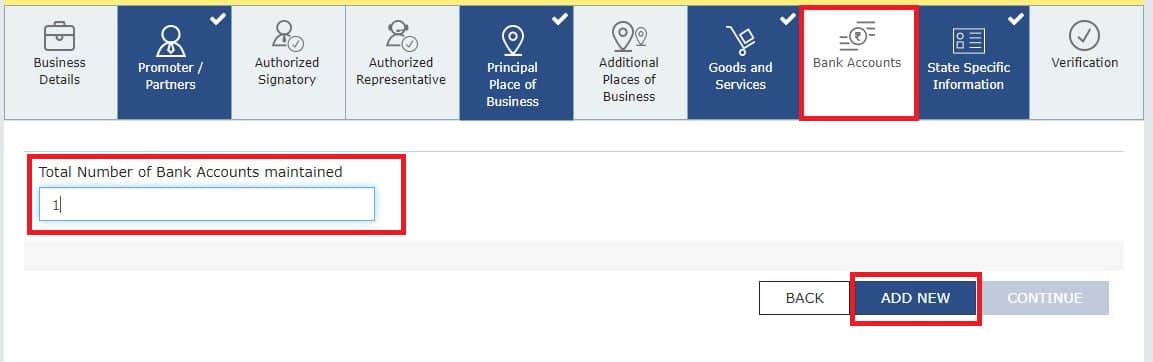

Click On Bank Accounts>Add Number of Bank Accounts to be updated> Click on Add New

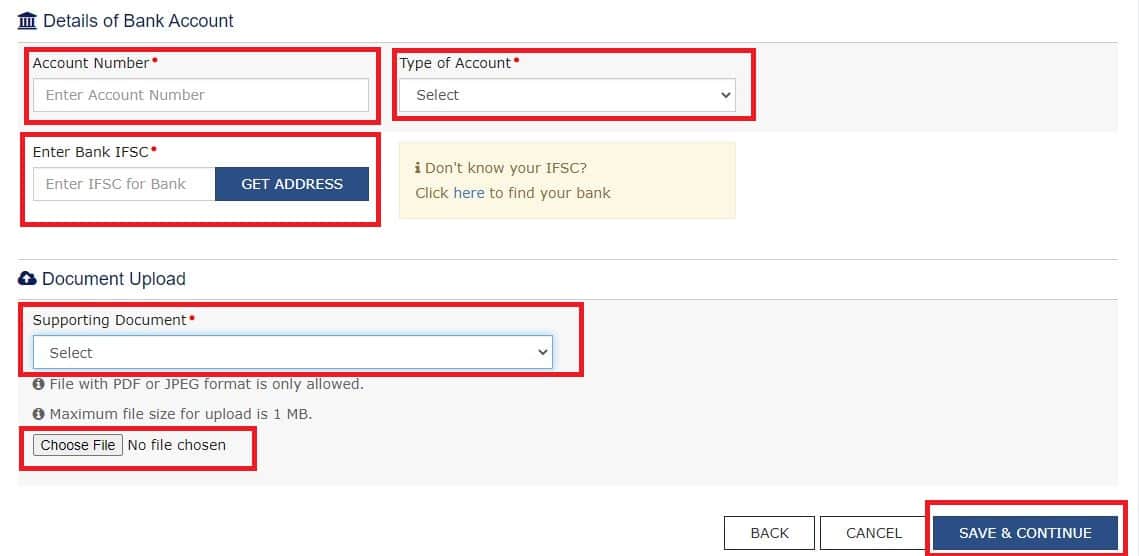

Step 4: Moving forward with the next step. A screen would appear like this.

Now, fill in the required information. Type in Account Number, IFSC Code, select the type of account whether it is Saving or Current Account.

Choose the supporting document. The supporting documents can be.

- Canceled Cheque having the name of the taxpayer

- Passbook Front Page

- Bank Statement.

Remember the name, account number, IFSC code should be mentioned on the supporting documents.

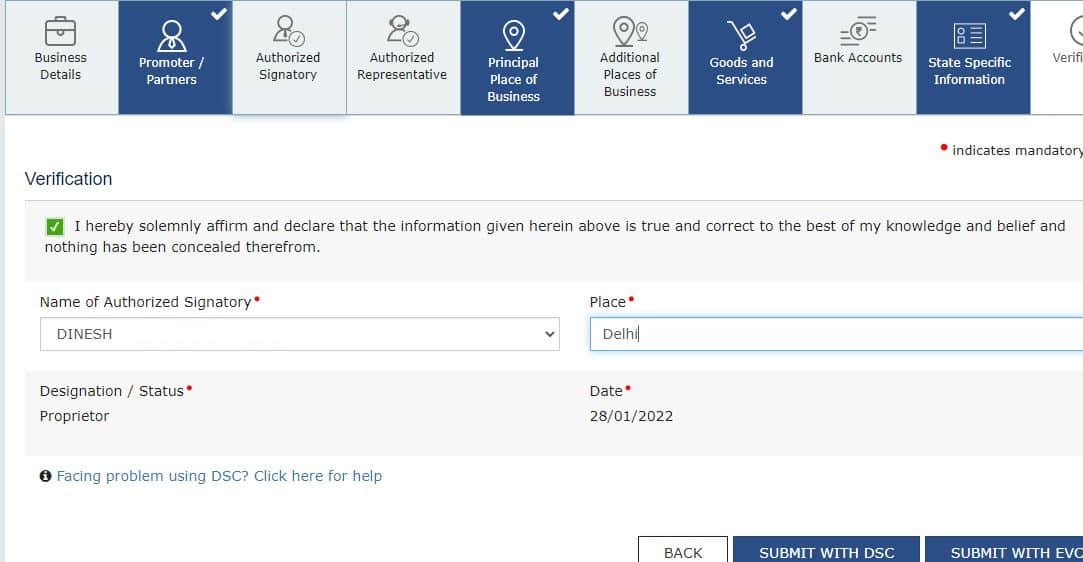

Step 5: The last and final step is to submit the application via Digital Signature or EVC code.

Go to the Verification tab, tick mark the box, select the name of the authorized signatory and enter the place of submitting the application. Now click on Submit with DSC or Submit with EVC whichever is suitable.

File the application and from now onwards, a warning sign would not appear once you login into the account and bank account is updated.