Page Contents

Common reasons for GST registration rejection

What we are going to learn in this post is an experience shared by one of our indirect tax experts who has registered numerous persons in GST. GST Registration problems and solutions are provided to give you an insight into what mistake you should not commit while submitting GST-Reg-01 on GST Portal.

Most taxpayers who apply for GST in India receive a show-cause notice after they file their GST Registration application. They get worried over what’s the mistake, and why the application is not accepted. Don’t worry the simple solution for such SCN is to provide clarification with the documents asked.

Learn: How to download SCN for new GST Registration?

The consent Letter is not attached or not on stamp paper

This is the most common reason for the issue of a notice. A consent letter is not attached along with the proof of ownership. Frequently, taxpayers forget to attach a consent letter or get it signed by the wrong person. Get a consent letter for GST registration.

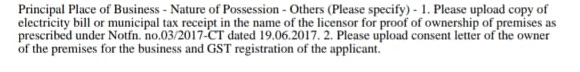

In case of consented or shared premises. consent is required from the owner to use the premises as a place of business for obtaining GST Registration. It is attached along with other address proof. It’s a secondary document while the primary document is still an Address Proof like Electricity Bill, Legal Ownership document, Municipal Khata Copy, and Property tax receipt.

However, attaching a consent letter is mandatory.

Look at the Show cause notice demanding a consent letter and other documents for proof of ownership.

Whether it should be notarized? Earlier attaching a consent letter on a blank paper used to work but now we are observing a large number of cases where notice specifically demands a consent letter on a stamp paper.

Download the Consent Letter for GST Registration

Providing Incomplete information in GST Reg-01

Incomplete information provided in GST Reg-01 such as not filling complete address as the principal place of business or not adding satisfactory information about the taxpayer and authorized signatory.

Get a Letter of authorization for GST and Board Resolution for appointing an Authorised Signatory.

Outdated and inaccurate documents attached

Attaching an outdated proof of ownership like an expired rent agreement will lead to the issue of a notice. We have observed cases where taxpayers have attached documents that are older than two years. How would the officer accept the application on the basis of such documents?

Providing a blurry passport-size photo would not work.

In the initial years of GST, a large number of taxpayers obtained GST registration on bogus documents. To mitigate such types of registrations, the GST department has implemented strict controls over documents now.

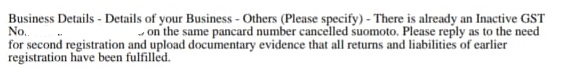

Suo Moto Cancellation earlier and obtained a fresh registration

Suo Moto Cancellation of GST is done by the officer for not filing GST returns for a period exceeding six months. Taxpayers who don’t start their business and do not commence filling of GST returns get suo moto cancellation done by the officers.

Now, what if the taxpayer has to again apply for GST registration on the same PAN number? Will the application be accepted? The answer is a big “NO”.

The officer will issue a show-cause notice demanding payment of penalty, tax, and late fees levied on earlier registration. Then only new registration would be obtained on the same PAN number.

License Required to conduct such business

For some businesses in India, a license is required to deal with such goods. For example, a petrol pump needs GST registration to sell lubricants on which GST is applicable. The notice would be received by such taxpayers for proving a license to deal in such goods from the proper authorities. Only then the application would be accepted.

Look at the extract of the show cause notice received for dealing in any such goods where the license is required.

Frequently Asked Questions on GST rejection

Yes, a new application can be filed for obtaining GST Registration only after the order has been passed by the officer rejecting the previous application on the same PAN number.

However, the new application will again be rejected if rectifications have not been made.

No, GST cannot be rejected without any reason. After submitting the application in GST Reg-01, a Show cause notice is issued in three days which specifies the errors and omissions in the application.

However, if the applicant does not respond to the notice, an order would be passed rejecting the application. This would not amount to rejecting the application without any reason.