Page Contents

What is a consent letter for GST Registration or a Non objection certificate?

A consent letter is a document that authenticates that the owner of the property has allowed his premises to be used by the taxpayer for the said business. A no-objection certificate or a consent letter for GST registration is required to be attached along with the Address proof of business.

What would happen if I will not attach a consent letter for GST registration? A Show Cause Notice would be received by a taxpayer to attach a consent letter. Look at the extract of a notice.

Where a consent letter is attached?

GST portal allows the following options as “Nature of Possession of Premises”.

- Consented

- Own

- Leased

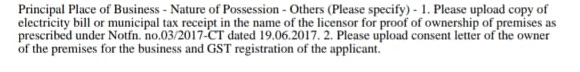

- Others

- Rented

- Shared

However, a consent letter is required only in the case of “Consented” and “Shared” premises.

In case you forgot to attach a consent letter along with the address proof, the GST officer will communicate with you via E-mail or Phone regarding the incomplete GST REG-01 (GST Registration form). In that case, the taxpayer will need to attach a consent letter later on.

Frequently Asked Questions on Consent Letter or Non objection certificate in GST

What is NOC for GST Registration?

A consent letter or No objection Certificate are one and the same thing. It is used to provide consent from the owner to taxpayer for use of premises as place of business in GST.

Is Consent Letter enough for GST Registration?

No, Attaching only consent letter will not work. You need to attach Address proof along with Consent Letter.

Is Letter or Authorization same as Consent Letter?

No, Letter for Authorization in GST Registration is attached for appointment of Authorized Signatory while consent letter is attached to give consent to use premises.

Whether consent letter should be on stamp paper or blank paper?

If premises is rented or leased and you are attaching “Rent Receipt” as address proof, then you should definitely get consent letter on stamp paper.

However, in case of consented premises, blank consent letter works most of the time. In some cases we have witnessed Show Cause Notice issued. So, it will solely depend upon you.

Can a consent letter be attached after receiving Show cause Notice?

Yes, a consent letter can be attached after receiving the Show cause notice. Such can be attached while submitting an application for clarification.