Page Contents

How to check GST Registration rejection reason on GST Portal?

GST Registration is rejected normally if a person fails to provide clarification or provides clarification that is not accepted by the GST officer.

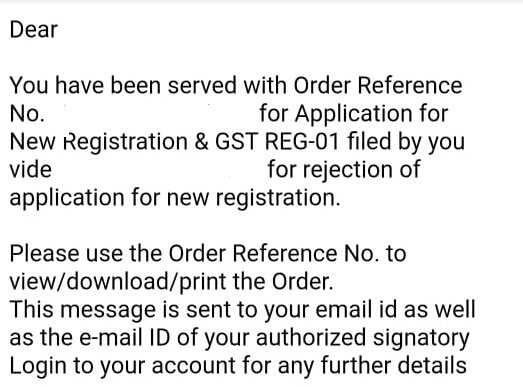

In case you fail to provide clarification to the notice or still the GST officer is not satisfied with the clarification or additional documents. The application initially filed in GST REG-01 is liable to be rejected and the order would be passed in Form GST REG-05.

The GST office would communicate the reasons for the rejection of the application.

If incorrect details of the PAN number are provided initially, the application is always rejected. PAN number is matched with the CBDT database and in case of any error, the application is rejected.

A ticket can be raised or GST Suvidha Center can be contacted if the taxpayer is contented with reasons of rejection mentioned in the order.

Whole Case Summary of GST Registration Rejection

The whole case summary of GST Registration rejection can be checked on GST Portal by just entering ARN Number. It will provide you complete insights into events that led to the rejection of the application. The only thing you need is an ARN number which is even mentioned in the order of rejection as shown above. (Hidden above in image).

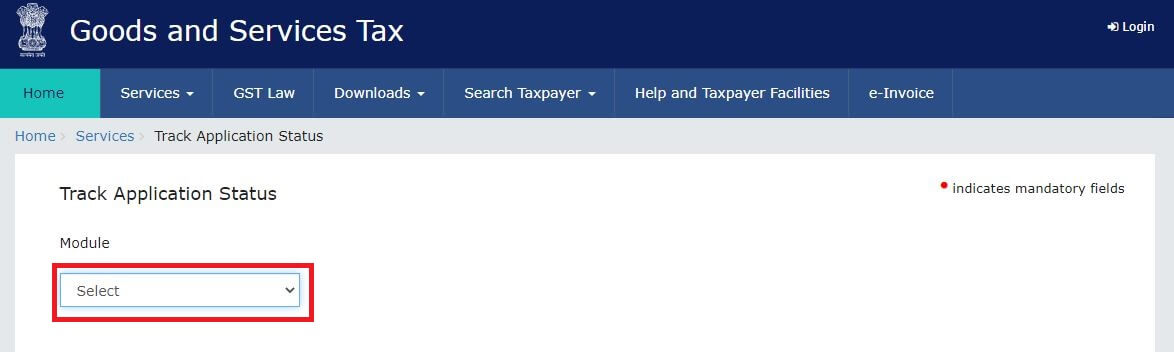

Step 1 Open GST Portal

Step 2 Click on “Track Application Status”

In the Services tab located in the top menu, you will find the Track Application status. Click on it.

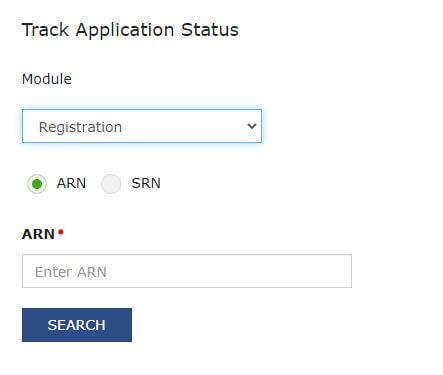

Step 3: Now click over “Module” and then select “Registration”

When you will click on the module, a drop-down menu will appear. You need to select “Registration” not “Refunds”.

Step 4 Enter the ARN Number along with the captcha.

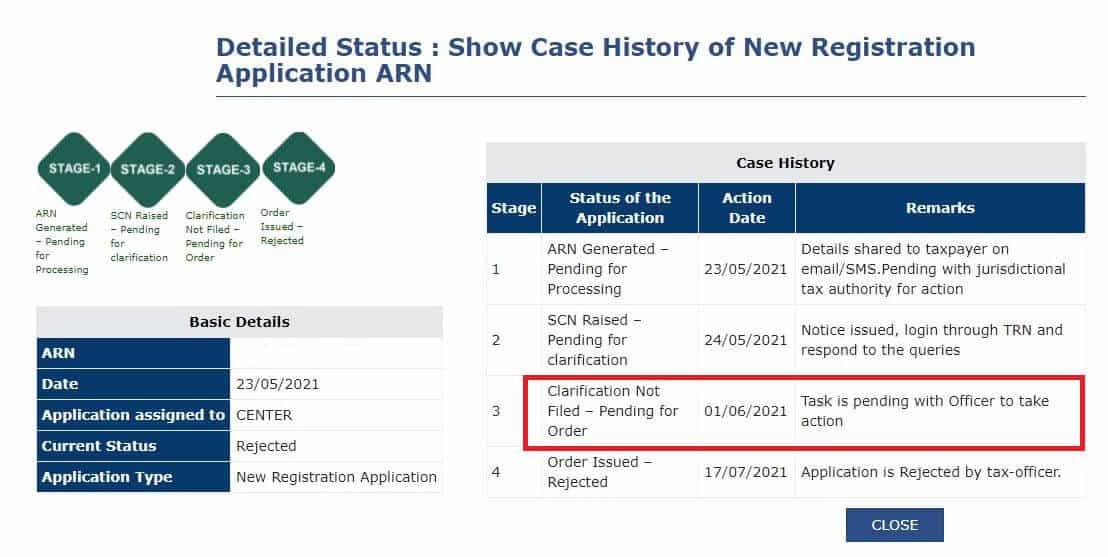

After entering the ARN number the whole case summary will be displayed from application filing to the issue of Show Cause Notice, to the clarification filed, and the order of rejection passed by the officer. Look at the summary of the case below.

The four stages of GST Registration application.

Stage 1: ARN Generated but pending for processing

It means GST Reg-01 has been filed and an ARN number has been issued which is mailed to the applicant.

Stage 2: SCN raised and pending clarification

There might be some deficiency in the application form which has led to the issue of Show cause notice.

Read How to download GST registration show-cause notice?

Read Common reasons why GST registration is not accepted.

Stage 3: Clarification filed or not filed

After the issue of the Show Cause notice, clarification needs to be filed along with other documents. If clarification is not filed within the prescribed time period, it will lead to the issue of the order rejecting the application.

Stage 4: Order Issued rejecting the application or application has been accepted

In the above case, the clarification has not been filed which has led to the rejection of the application. However, in case of clarification has been filed along with requisite documents. The application can be accepted by the officer and a GST Registration certificate would be issued then.

If the clarification is not up to the mark or the officer is not satisfied with the documents, he can reject the application.

The whole summary of the case is displayed above. Look at the reason why GST Registration is rejected.

Frequently Asked Questions on GST Registration rejection

Yes, the reapplication can be made only after the issue of Order rejecting the initial application. The order would be communicated via mail and can be downloaded from the GST portal also.

When there is some deficiency in the GST registration application, Show cause notice would be issued to rectify the deficiency. The issues mentioned in the notice become the primary reason for the rejection of the application.

The other way to find out the reason is to look at the complete process as illustrated above.