Page Contents

Additional Vs Principal Place of Business in GST Registration (GST REG-01)

When we are applying for GST Registration, there is a specific column for adding Principal and additional place of business in GST. We are going to move step by step and understand why having an insight into the principal place of business is important.

Definition of the place of business in GST

According to Section 2(85): a place of business includes,

- a place from where the business is ordinarily carried on and includes a warehouse, a godown, or any other place where a taxable person stores his goods, supplies, or receives goods or services or both; or

- a place where a taxable person maintains his books of account; or

- a place where a taxable person is engaged in business through an agent, by whatever name called.

Now, let’s move further.

Definition of Additional & Principal Place of Business in GST

First, we need to understand some basic terms according to CGST Act. The Act under Section 2(77), “principal place of business” means the place of business specified as the principal place of business in the certificate of registration where the taxable person keeps and maintains the accounts and records as specified under section 42.

According to the definition, the principal place of business in GST is the place mentioned in the GST Registration Certificate (GST-Reg-06). Irrespective of the fact, where business is conducted. The place mentioned in the registration certificate will be considered a principal place of business. So, it is the principal place of business where we need to maintain our documents like the Sale Register, Inventory Records, and Purchase Details.

Learn: How to download GST Registration Certificate?

While Additional Place of business is the place of business where taxpayers accomplish business-related activities within the State. All other business premises which are separate from the principal place must be considered as an additional places but must be located within the state.

Can we add additional places of business in other states in GST?

In case, the premise is located in a different state then separate GST Registration must be obtained for the same. That premises shall not be considered as an additional place of business. The reason for the same is in different places different states will have right over the revenue and separate GST officers would have been allocated. Therefore, we cannot add additional places of business in other states.

Types of Principal Place of Business and Proofs

While registering for GST, there is an option to select the place of business as follows.

- Owned: The person filling out the application is the owner of the place. For owned premises, a copy of the electricity bill, Property Tax Receipt, Municipal Khata Copy, and Legal Ownership document must be attached.

- Rented: The person has taken the place of business on rent. For rented premises, a rent agreement should be attached.

- Leased: The person has taken the place of business on lease. Not much difference is there between a lease and a rented one. A lease agreement should be attached while filing GST Reg-01

- Consented: A consented premise is one where the owner has given consent to the applicant to use the property as a place of business. A Consent Letter or Non-Objection Certificate needs to be attached.

Read: Download Rent Agreement for GST Registration

Read: Consent Letter for GST Registration

How to add a principal place of business in GST?

A principal place of business in GST is mandatorily required to be added while filing a GST Registration application in GST REG-06. Often we see a lot of show cause notices issued to the applicants for incorrectly adding details of the principal place of business. Necessary documents as a place of business proofs are also attached along with the GST Registration application.

The principal place of business can be changed also, which we will read about further.

How to add an additional place of business in GST?

Additional and Principal places of business can be added while filing the GST Registration application. Also, an amendment can be made after obtaining GST Registration to add additional places as well as change principal place but within a state.

So, let’s learn how to add/change the additional places of business in GST.

Step 1: Log In to the GST Portal

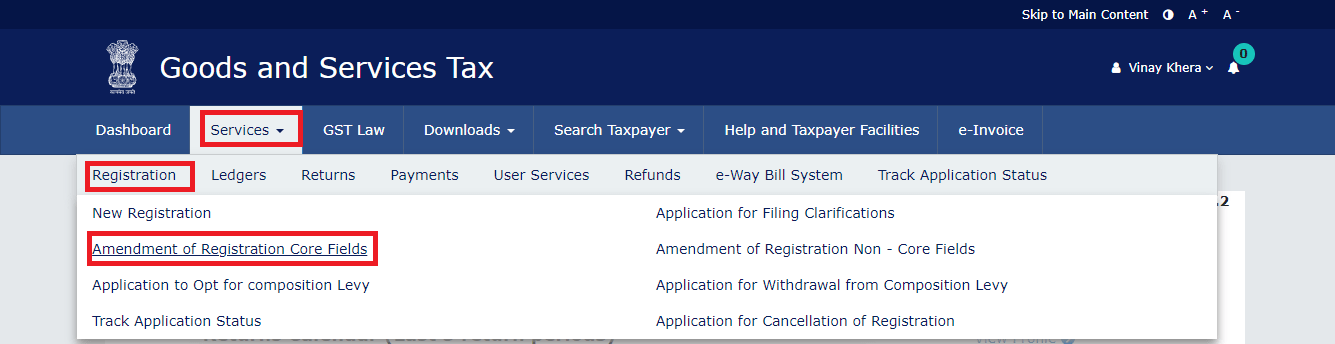

Step 2: After logging in to the portal, one should move towards the navigation menu in the top bar. Go to Services> Registration> Amendment of Core Fields.

The place of business fields are considered as core fields and once changed require approval of the respective GST officer. While Noncore fields like updating email or phone do not require approval of the GST Officer.

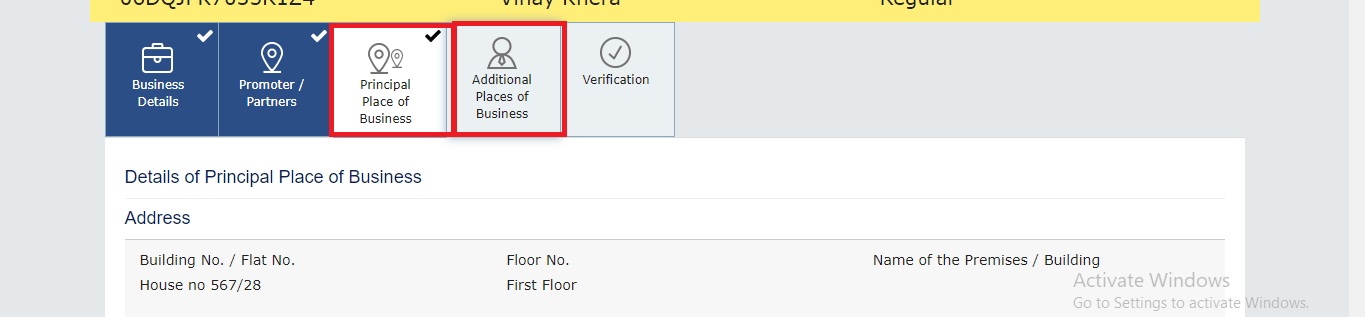

Step 3: Various core fields appear on the screen for amendment. Now, to edit the principal place of business. Start editing the principal place of business fields and in case you want to add “Additional Place of business” Go to that tab.

Step 4: To add information in “Additional Place of Business”, first go to the bottom of the “Principal Place of Business Tab” and then choose to add an additional place of business.

Step 5: Now, come back to the additional place of business tab and add how many places in a state needs to be added. In case of one, enter 1 & then press enter button.

Step 6: Add details of the premises, choose the nature of the place of business and attach the relevant document.

Step 7: File with EVC or with DSC.

Penalty for not registering an additional place of business in GST

There is not any specific penalty referred for not registering an additional place of business. However, a general penalty which is Rs. 25000 can be levied for not adding it. One should display the GSTIN number along with the Trade name outside the premises and inside the premises display GST Reg-06 (GST Registration Certificate) at the place of business.