Page Contents

GST Returns for eCommerce sellers – Flipkart

The blog post is regarding How to file GST Returns like GSTR-1 and GST-3b for eCommerce sellers like Flipkart and Amazon. To file any return first we need to understand how we are gathering source data.

Source data for E-commerce seller’s returns is a report generated by E-commerce operators like Flipkart and Amazon. They provide different types of report which is used for return filling like Sales Report, GSTR Report and MTR report for Amazon.

The other data we require is details of purchases made during the period and input tax credit levied on them. We need to claim only those credits are not blocked under Section 17(5) and eligible conditions mentioned in Section 16 of the CGST Act are satisfied.

Read: Block credits under GST under Section 17(5)

Read: Eligibility conditions to claim Input Credit in Section 16

Before directly moving upon how to file returns for eCommerce sellers we need to learn how to download reports for GST returns from Flipkart and Amazon Seller Account. You need to learn about this before directly moving upon return filling.

Learn: How to download reports for E-commerce sellers?

In this article, we will only discuss GST Returns, to learn how to claim Tax Collected at Source in GST by E-commerce operators we will write a different post.

How to file GSTR-1 for Flipkart?

The article would be written taking Flipkart Source data. For Amazon and other E-commerce sellers, you can follow the same procedure. However, the names of the reports would be different rest of the procedures would be similar.

After downloading the reports from Flipkart namely

GSTR Report: It would be mainly used to file GSTR-1 and it will show the amount of tax collected at the source.

Sales Report: It would be used to verify the data which is going to submit in the GSTR-1 return.

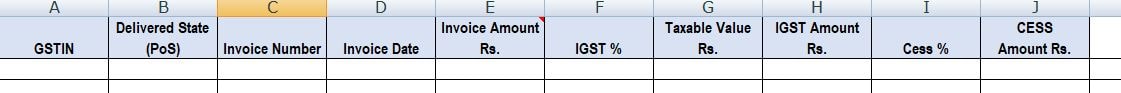

After downloading GSTR Report from Flipkart which would appear like this. It would contain 8 excel sheets namely,

Sheet 1: It would be displaying all Business to Consumer transactions only when Invoice Value is more than 2.5 Lacs. There are extremely less instances where online sales made via Flipkart or Amazon would be higher than 2.5 lacs for a particular item.

Since, in this case, the seller has not issued any invoice exceeding Rs. 2.5 Lacs. There is no need for entering into GSTR-. But still, we will guide you on how it would be reported.

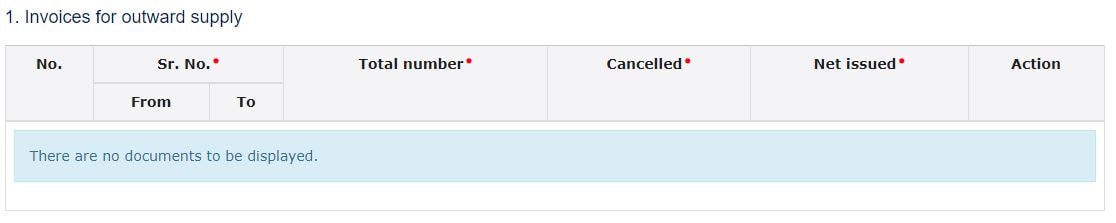

Open GSTR-1 for that month and the second table of GSTR-1 would appear like this.

The details of any Business to Consumer sales of more than 2.5 lacs would be added here.

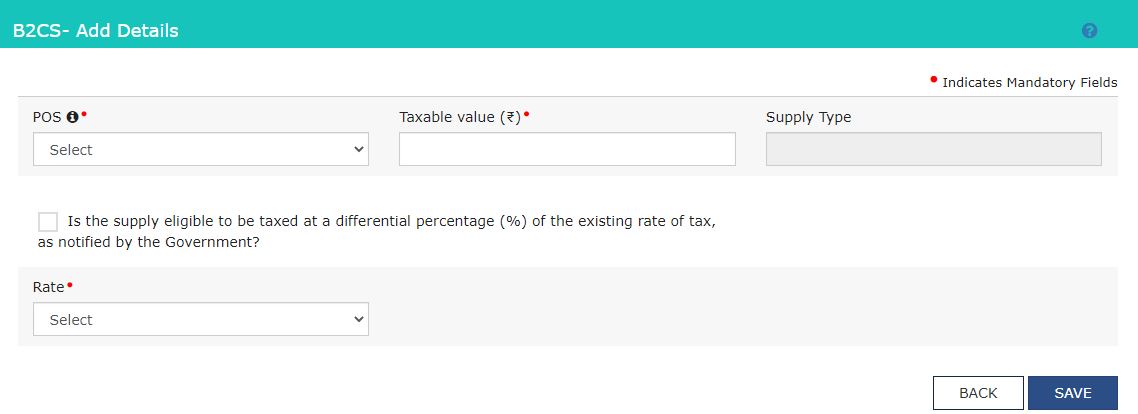

Sheet 2: Details of all Intra State (Local Sales) from Business to Consumer. If the customer is located in the same state CGST and SGST are levied.

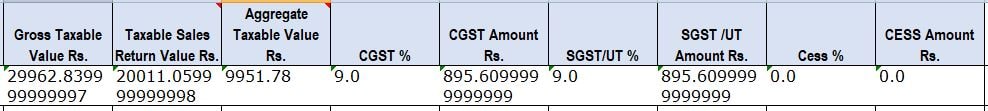

Sheet 3: It would be displaying all Interstate Business to Consumer transactions only when Invoice Value is less than 2.5 Lacs. If the Customer is located in a different state than that of the supplier, IGST would be levied as goods are finally sold in that particular state.

In Sheet 1 details of Intra States, Sales mean Local sales are provided and in Sheet 2 details of Inter-State sales are provided.

For example, If an E-commerce seller is located in Haryana and sales are made to customers located in Haryana, that would be intrastate sales and CGST & SGST would be levied. Similarly, if a customer is located outside Haryana State it would be an interstate sale and IGST would be levied.

What columns do we require for GSTR-1? We need to focus upon

(a) Place of Supply

(b) Aggregate Taxable value (Sales after deducting returns)

(c) Rate of Tax

(d) Taxable Value

(e) Amount of Tax whether IGST or CGST and SGST

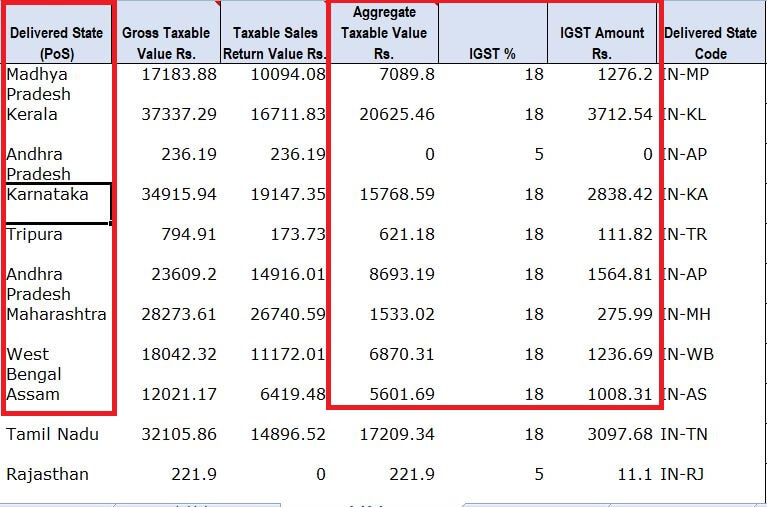

We need to scroll at the bottom and on the left side, we will find this box.

Now once you enter this box, there will be the option to “ADD NEW”. When you will click on ADD NEW button, a form will appear with details like this. “POS” refers to the Place of Supply, for goods Place of supply is the place where supply terminates which is the location of the buyer. Now the taxable value is the amount that excludes GST and is net of any Sales returns.

Now you need to fill in the data as we have prepared above. We are going to add both Inter-State sales and Intra State sales made Business to Consumers in this form. Place of Supply would be the same as extracted in the report and other details also.

Note: Don’t forget to click on the “Save” button and don’t enter details of Business to Business sales in this form. Those will be reported elsewhere.

Business Sales are those in which the recipient has provided his GSTIN number to claim Input Credit

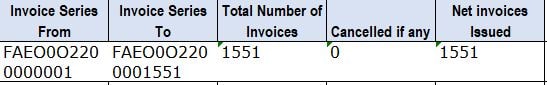

Sheet 4: List of all invoices issued during the period including sales returns. In Flipkart GSTR Report you will find details of all invoices issued during the month.

We are going to enter these details in GSTR- also in the 13th column of GSTR-1.

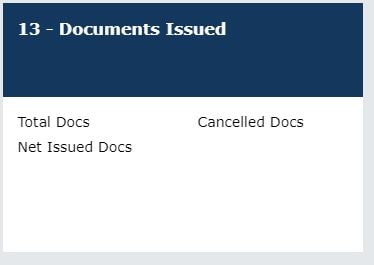

After entering this column, a screen would appear like this.

We have to enter details about the number of invoices issued and canceled. This would be provided by all the E-commerce operator reports.

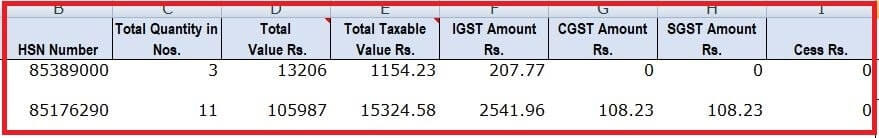

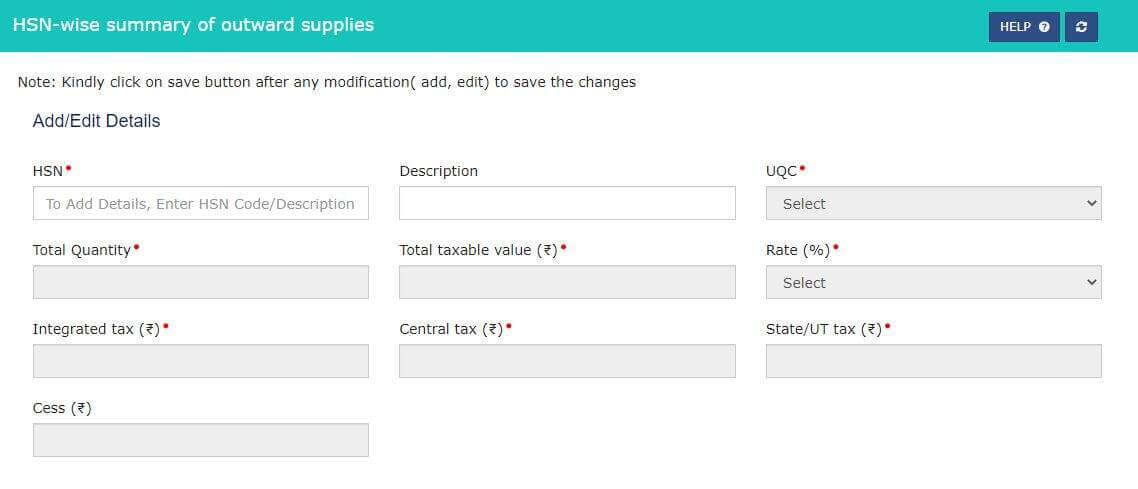

Sheet 5: HSN-wise sales made via E-commerce Sellers.

Flipkart provides details of all HSN-wise sales made through it. The details would be provided in GSTR Report for that period. We need to add HSN-wise details in GSTR-1 also.

At the bottom of the page is Column number 12. You will find the option to Add HSN Details. After clicking upon HSN Details a page will appear which will appear like this. Don’t change anything from Flipkart Source data and directly fill the boxes as provided above.

After submitting the details, always check whether your HSN details match with Net sales as shown in B2c above.

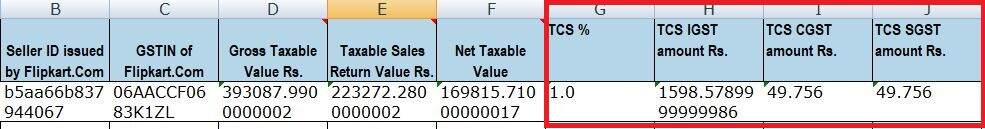

Sheet 6: The amount of TCS collected by the E-commerce operator would be 1% of total sales made during the period. E-commerce operators like Flipkart and Amazon are required to collect TCS at 1% which will be 0.5% CGST and 0.5% SGST.

The amount of TCS collected by Flipkart is not shown in any GST Return by the seller.

The TCS collected is credited to the Electronic Cash ledger when the TCS return is submitted by the seller on GST Portal. In simple words, the TCS collected by Flipkart gets refunded to the seller.

We will learn about how TCS return is submitted in our next blog post.

Since TCS is collected at the rate of 1%. We can reverse calculate and find out the actual value of aggregate turnover(Sales) in case of any doubt or a double-check.

While reverse calculating takes the combined value of TCS IGST, CGST & SGST.

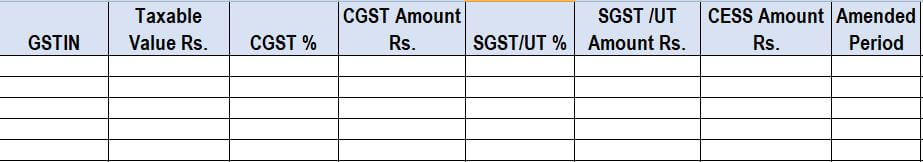

Sheet 7: Any amendment made by the E-commerce operator for that particular seller.

Mostly Flipkart or any other large eCommerce operator does not make any amendments. In case any amendments are done by Flipkart that would be shown in the last sheet of the GSTR Report extracted from the Flipkart report section.

See above, it’s empty, which means no amendment is done by Flipkart for the particular period.

What if any amendment is done? How would that be reported in GSTR-1?

Amendments should be separately reported in GSTR-1 in their respective columns like Amending B2b sales or Amending B2C sales.

How to file GSTR-3B for Flipkart Sellers?

After submitting GSTR-1, the data gets auto-populated in GSTR-3B automatically along with auto-populated Input tax credit. Filling GSTR-3B is not so complicated, GST Portal has made this return easier by auto-populating data.

Our checkpoints while filling GST-3B.

Whether any auto-populated Input credit contains any blocked credit as read above?

Whether all the Input tax credit has been reflected in GST-3B?

Now, understand from where data is getting populated. Outward supply details are getting populated from GSTR-1 while Input credit details are getting populated from GSTR-2B and GSTR-2A.

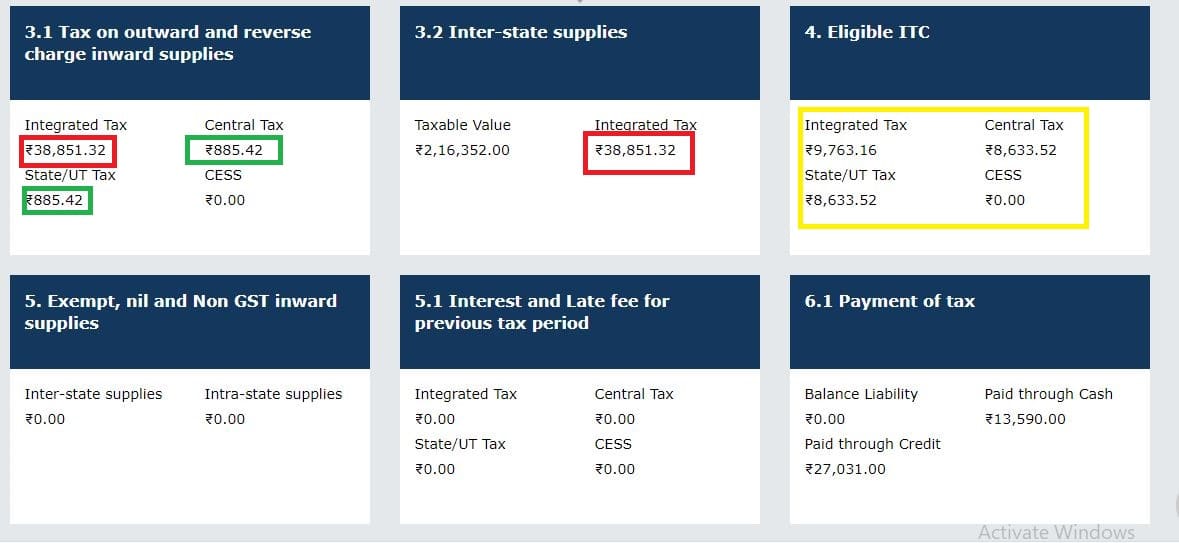

Column 3.1 will be auto-populated from GSTR-1 and Column 4 will be auto-populated from GSTR-2B.

IGST Output (In Red) shown in GSTR-1 should match with Column 3.2 IGST.

CGST and SGST Output (In Green) are shown in GSTR-1 in Column 3.1 auto-populated from GSTR-1.

IGST, CGST & SGST (In Yellow) are input tax credits auto-populated from GSTR-2B. To check the invoice wise we need to open GSTR-2B.

After checking all the details, we need to click on the “Save” Button at the bottom of the page and then pay the tax via ITC or in Cash. Then File the return after obtaining the EVC code or DSC.

Frequently Asked Questions

Yes all e-commerce sellers are required to file GST returns except those who have not obtained registration and all are selling GST exempted products.

E-commerce sellers are required to file normal GST returns like GSTR-1 and GST 3B.

But E-commerce operators like Flipkart and Amazon, they are required to file GSTR-8.

TCS is collected by E-commerce operators at the rate of 1% of aggregate turnover of that period. And such TCS can be claimed by the E-commerce sellers from GST Portal. Such amount gets credited to Electronic Cash Ledger and can be used to pay GST, Interest and Fees.

No, a statement of TCS/ TDS is filed to claim the amount.

In case of any error or any omission the amount can be changed. Although, it will be highlighted in red if change is significant.

No, in GST there is not any provision of revision of returns. Corrective action can be taken in subsequent returns.

There are instances when sales returns are more than sales in a subsequent month. For that month GSTR-1 should be filed with negative values and GSTR-3b should be filed with zero amount.

In the subsequent month, if you have tax liability, adjust the previous negative tax amount.