Page Contents

TDS on Purchase of Goods above 50 lakhs under Section 194-Q

In light of the insertion of the new provisions in the Income Tax Act, 1961, and amendments thereof through the Finance Act, 2021, we would like to discuss the impact of such TDS provisions on our business transactions in order to comply with such income tax law requirements.

First, we need to understand the relevant provision under the bare Act, afterwards, we will analyze the same with the examples.

Section-194Q TDS Applicability and Rate

“Any person, being a buyer who is responsible for paying any sum to any resident (hereafter in this section referred to as the seller) for purchase of any goods of the value or aggregate of such value exceeding fifty lakh rupees in any previous year, shall, at the time of credit of such sum to the account of the seller or at the time of payment thereof by any mode, whichever is earlier, deduct an amount equal to 0.1 percent of such sum exceeding fifty lakh rupees as income-tax.

Explanation: For the purposes of this sub-section, “buyer” means a person whose total sales, gross receipts, or turnover from the business carried on by him exceed ten crore rupees during the financial year immediately preceding the financial year in which the purchase of goods is carried out

The provisions of this section shall not apply to a transaction on which:

(a) tax is deductible under any of the provisions of this Act; and

(b) tax is collectible under the provisions of section 206C other than a transaction to which subsection (1H) of section 206C applies.

Also, when TDS is liable to be deducted by us, TCS on Sale of Goods u/s 206c(1H) is not applicable and we should request our suppliers to not collect the same w.e.f. 1st July 2021 because TDS provisions supersede TCS provisions. Initially, this shall look like a burdensome process, but it is a one-time thing during the initial transition phase and be streamlined in the coming months.

Disallowance of Expense if TDS not deducted

In case you fail to deduct TDS or fail to remit it to the government before the due date of filing of return under section 139(1), the expense would be disallowed @ 30%

Let us say, ABC Ltd has made the purchase of goods worth Rs. 70,80,000/- (Basic Rs. 60,00,000 + GST @18% Rs. 10,80,000/-) in FY 2021-22 from Supplier Alpha Limited. The transaction occurred after 1st July 2021 i.e. when Section 194-Q came into effect. ABC Ltd was liable to deduct TDS @ 0.1% on value exceeding Rs. 50,00,000/- i.e. Rs. 10,00,000/-. TDS comes to Rs. 1000/-.

In case of ABC Ltd fails to deduct the same, the expense of Rs. 10,00,000/- shall be disallowed 30% i.e. Rs. 300000/

Assuming ABC Ltd come under the tax slab of 25%, your income tax liability shall be increased by Rs. 25,000/-

Practical Implementation of provisions of Section 194 Q

How can we practically implement Section 194Q TDS provisions in a company? It will be a little complicated the first time, but once understood things will get easier.

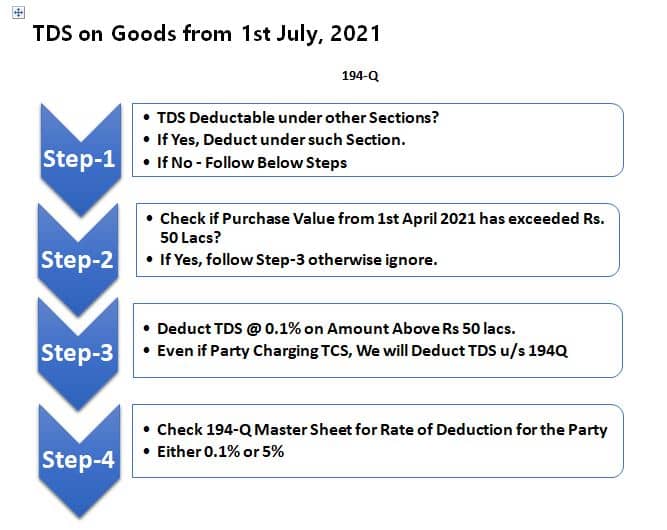

We have prepared the Step by Step Guide on Practical Implementation.

Step 1: The first step here would be to find out whether TDS is deductable under other sections. If Yes, deduct under those sections, and in case of No move to Step Number 2.

Step 2: The second step is the most important step that is to find out the Purchase value from which suppliers have exceeded Rs. 50 lacs from 1st April 2021. In case, purchase value has exceeded Rs. 50 lacs of a respective supplier, then move to Step Number 3 otherwise ignore.

What do we recommend?

We recommend maintaining a Supplier Master Tracker where you could track the aggregate TDS and transaction amount. Create a column “TDS rate for respective supplier” in the master sheet.

Step 3: The third step is a deduction of TDS at the rate of 0.1% on an amount exceeding Rs. 50 Lacs. Even if the party is charging TCS, still we have to deduct TCS under Section 194Q.

While deducting TDS, keep the following things in mind.

- TDS has to be deducted on the Amount excluding the GST component.

- Communication with your supplier is important so as to inform them about the TDS Deduction.

- If any of your suppliers is collecting TCS under section 206C(1H) for the transactions which require the TDS Deduction under section 194-Q, Please inform them not to collect TCS as TDS provision exceeds TCS provisions.

Step 4: Check for the rate of deduction of TDS whether 0.1% or 5% from the master data prepared above. and don’t forget to the timely deposit of TDS is important to avoid interest and conflict with your suppliers.

How Gstmentor helps companies?

We assist our clients in maintaining supplier databases and timely deduction of TDS. Compliance is our core expertise and we believe it should be handled with due care and diligence.

Drop us a mail at contact@gstmentor.com or directly Whatsapp/Phone at +918588918033 in case you need our assistance!

Harshit has a wide experience in different domains of Accounting, Auditing and Statutory Compliance.

He is a CA Finalist and currently employed as an Assistant Manager Accounts in a Steel Manufacturing Unit in Goa.

He believes in collective growth of the team and continues to be more of a friend than just a colleague. When not on his desk, he can usually be found capturing the streets around him from his mobile camera.