Page Contents

All about TDS and TCS Credit Received: How to claim & FAQ

Before we directly jump upon the procedure to claim a TCS refund. We need to analyze the provisions of GST regarding TCS. Understanding why it is collected, what is the rate, and what is the significance of such collection.

So, as usual, starting with definitions. Understanding some common words used in this blog. E-commerce is simply selling goods or services using electronic or digital networks.

Electronic Commerce Operator: It means any person who owns, operates, or manages a digital or electronic facility or platform through which sales are made. Like Amazon, Flipkart.

Electronic Commerce Seller: We all know Amazon, Flipkart never produce goods, all goods are sold by sellers registered with them. A person who sells goods through an E-commerce operator is an E-commerce seller.

Now, moving on to the GST Provisions.

Section 52 of CGST Act, 2017: TCS Mechanism in GST with example

Notwithstanding anything to the contrary contained in this act, every electronic commerce operator not being an agent shall collect an amount not exceeding 1% on the net value of taxable supplies made through it by other suppliers where the consideration with respect to such supplies is to be collected by the operator. 0.5% for CGST and 0.5% for SGST respectively.

Let us decode this provision by taking the example of Flipkart. and ABC Ltd.

ABC Ltd made sales to customers via Flipkart of Rs. 100,000 and sales returns are Rs. 10,000. Then TCS would be collected on what amount by Flipkart.

See, sales are made via Flipkart by ABC Ltd, instead of directly transferring the money from customers to ABC Ltd. Payments are routing via Flipkart, this is the primary reason Flipkart is collecting TCS.

TCS deduction on Gross or Net Amount

Understanding what is the Net value of taxable supplies or simply net sales, It means the aggregate value of taxable supplies of goods and services or both, other than services notified under Section 9(5), made during any month by the registered persons through the operator, reduced by the aggregate value of taxable supplies returned to it, during the said month.

Now, Understand the meaning of Turnover or Sales, or Taxable Supplies. Turnover never includes any Reverse Charge Inward Supplies always remember in life.

Net Sales: 100,000-10,000 = 90,000

TCS Amount: 90000*1%= 900

We will always forget to take net sales, so thing from a logical point of view. The sales which would have not been happened(Sales Return), Why would TCS be deducted on such amount?

Take another example: Suppose Gstmentor starts selling books from its own website. Whether TCS would be collected on payment received by the customer to gstmentor.

No, the answer is simply no, since there is no e-commerce operator involved. All the payments will be directly be collected by gstmentor.

TCS under GST from 1st October 2018

Section 52 as read above has been applicable from 1 October 2018 via Notification Number N/N 51/2018 dated 13/09/2018. Before 1st October 2018, there was no liability on eCommerce operators to deduct TCS.

Returns and Collection of TCS

The power to collect the amount shall be without any prejudice to any other mode of recovery from the operator.

Every operator who collects TCS shall furnish a statement, electronically containing, the details as specified below.

- Details of outward supplies of goods and services or both affected through it.

- Including the supplies of goods and services or both returned through it.

- The amount collected(TCS) during a month in GSTR 8 within ten days of the end of the month.

The amount so collected by the operator shall be paid to the Government within ten days after the end of the month in which such collection, in such manner as prescribed. (GSTR-8)

Example: Flipkart collected TCS of Rs. 2500 for the month of July, such should be submitted to the government by the 10th of August, which would be the due date of GSTR-8.

Rectification of errors of TCS collected by Operators

There are instances when e-commerce operators commit errors in GSTR-8 and the reports generated by them. Such errors are rectified by them in near future. It is provided in GST Act, under subsection (6),

If any operator after furnishing a statement (GSTR-8) discovers any ommissions or incorrect particulars therein, he shall rectify such omission or incorrect particulars in the statement to be furnished for the month subjection to payment of interest under Section 50(1) (Rate: 18%)

Rectification is allowed up to the 10th of October after the end of the Financial year. However, if the annual return is submitted has been filed before the 10th of October, then the due date is the date of the annual return. Simply earliest of them.

How to Claim TCS & TDS refund on GST?

Before we directly jump upon the procedure on how to claim a TCS refund in GST. We have to understand some basic provisions first and some exceptions. First, we are going to understand how TCS works in GST for eCommerce sellers and operators. You must read the below post before moving further.

In a similar way, TDS credit under GST is claimed.

After reading the above post you would have understood the concept of GSTR-8 E-commerce operator return. Once GSTR-8 is filed, TCS starts getting reflected in “Statement Of TCS and TDS” which we are going to learn in this post.

Whether GST law provides a refund of TCS and TDS? Yes, Look at the below provision under Section 52.

The supplier who has supplied the goods and services or both through the operator shall claim credit, in his electronic cash ledger, of the amount collected and reflected in the statement of the operator in such a manner as may be prescribed.

Under Rule 87(9) Any amount deducted or collected under Section 51 & 52 and claimed in Form GSTR-2 by the registered taxable person shall be credited to his electronic cash ledger in accordance with the provisions of Rule 87

How to file a statement of TCS and TDS on GST Portal in 7 steps?

In this article, we are going to learn about TCS. TDS so deducted in GST is also claimed in a similar way.

Step 1: The first step would be to open the GST portal at gst.gov.in.

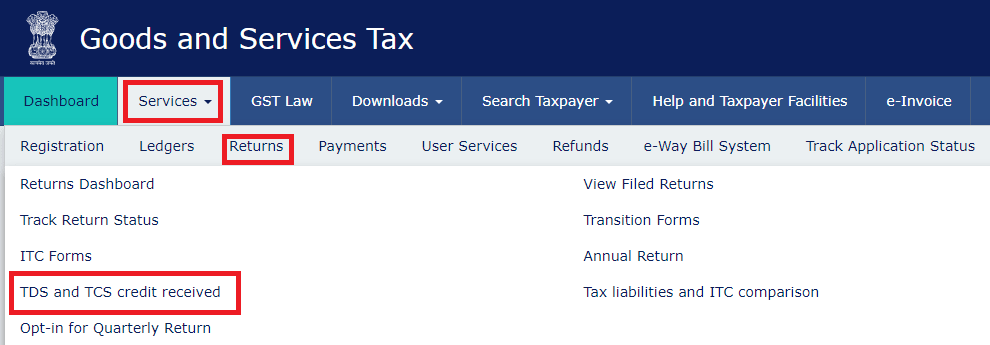

Once the GST portal is opened, we need to move on to the navigation menu and under the “Services” tab, hover on to the “Returns” tab, and then move on to the “TDS and TCS credit received”.

Wondering Why the name TDS and TCS credit were received, it is because an E-commerce operator who will collect TCS and such TCS would be transferred to you.

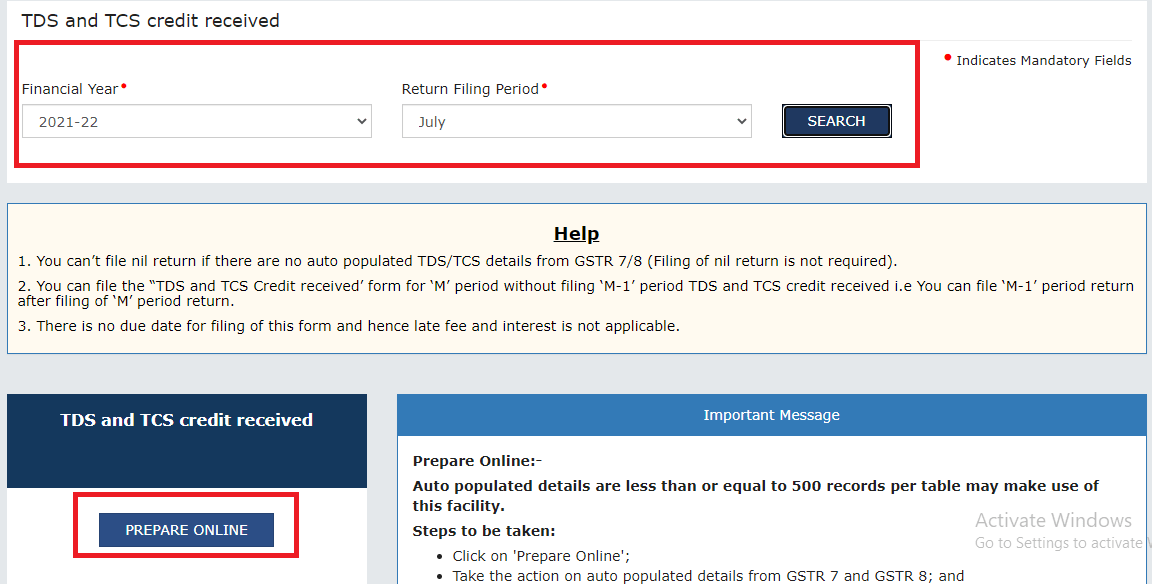

Step 2: The second step would be to select the “Financial Year” and “Return Filling Period”. TCS would be collected monthly by the eCommerce operator. In case of no sales, there would not be any TCS or TDS credit received.

Now move to the bottom and you will see “Prepare Online”. Click on prepare online to move to the next step.

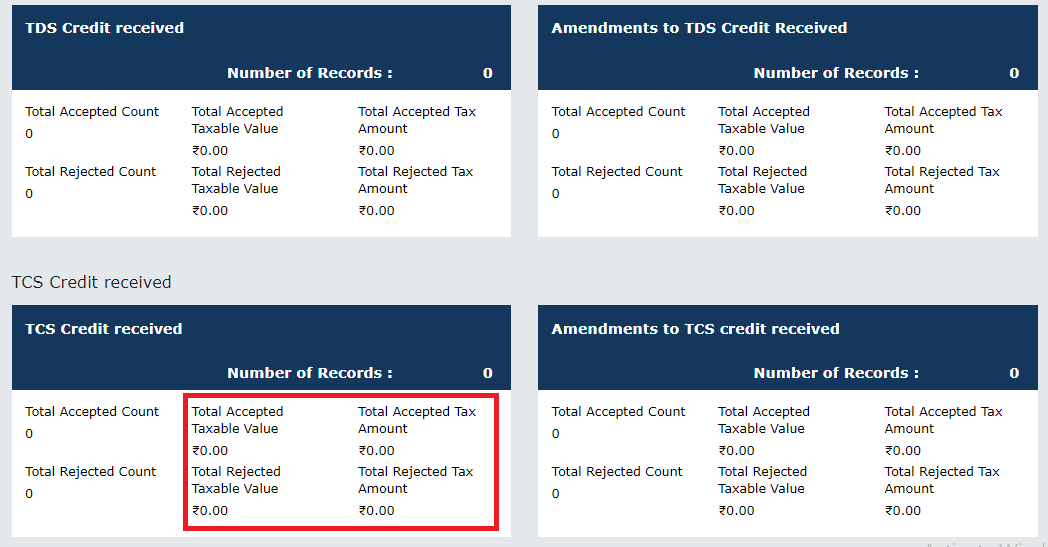

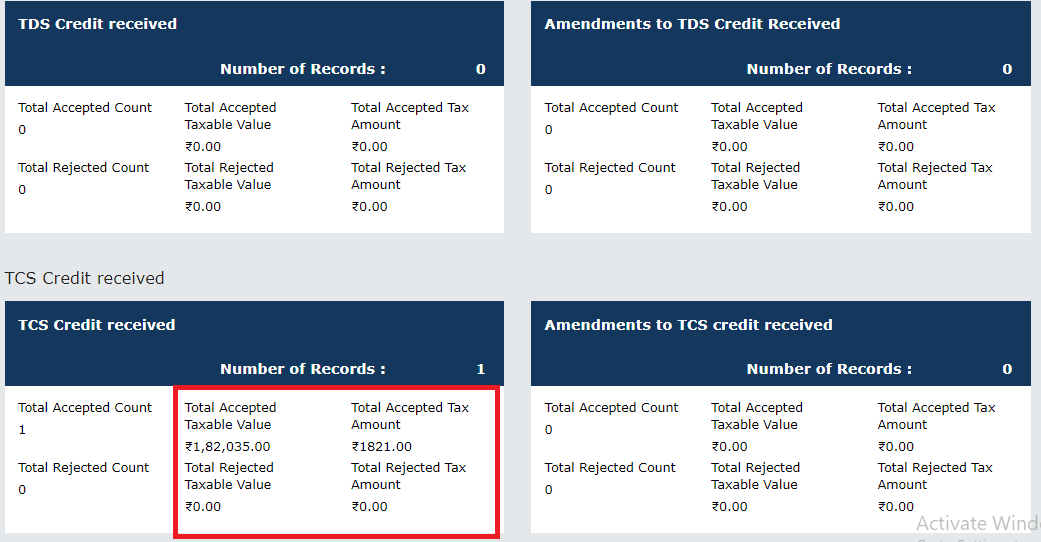

Step 3: After clicking on Prepare online, the screen would appear divided into four boxes.

- TDS Credit Received

- Amendments to TDS Credit received

- TCS credit Received

- Amendments to TCS Credit Received

It would be showing zero in all four boxes. No need to worry and think, that our TCS or TDS was collected and we haven’t received the refund. Now if your TDS is deducted click on Box 1 and for TCS click on Box 3 in the same series.

We are going via TCS, so we are going to click over the TCS box.

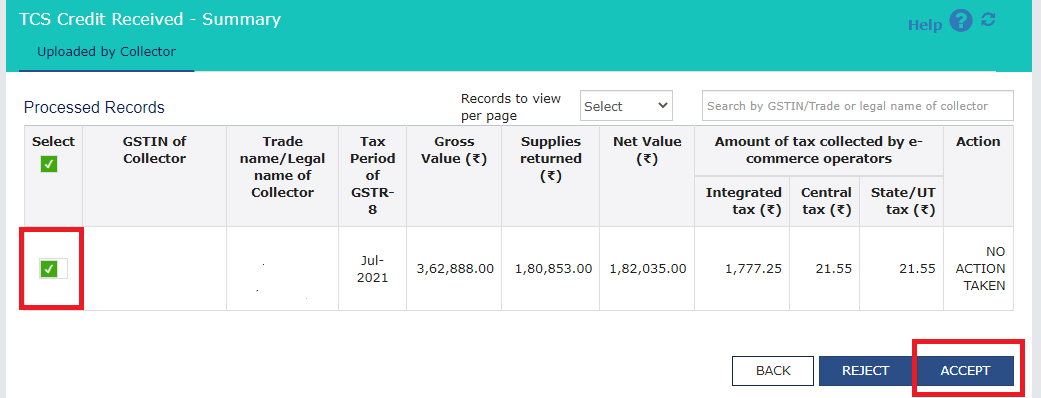

Step 4: If TCS has been collected, it would appear like below. Now we have to accept this TCS in GST after checking the amount. Whether the same is right? Don’t accept any TCS which is by mistake showing here.

The tick button should be green and then click on the “Accept button”

Once accepted, the amount will start reflecting on the main page.

Step 5: Look at the image below, now it is not showing blank rather amount we have accepted is reflecting there. Always check whether the same amount is getting reflected there. It is necessary, in case it is not showing, you have committed an error or you have not accepted the TCS or TDS correctly.

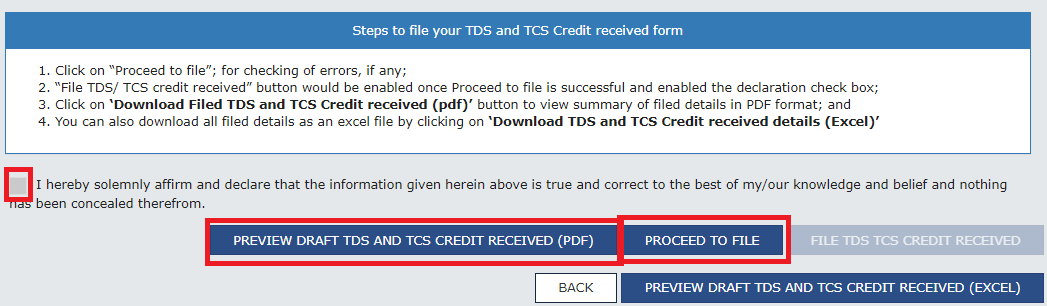

Step 6: The next step is to file the return but make sure you download the “Draft” version before clicking on the “Proceed to file” button, once clicked on Proceed to file, it will take you to the OTP page.

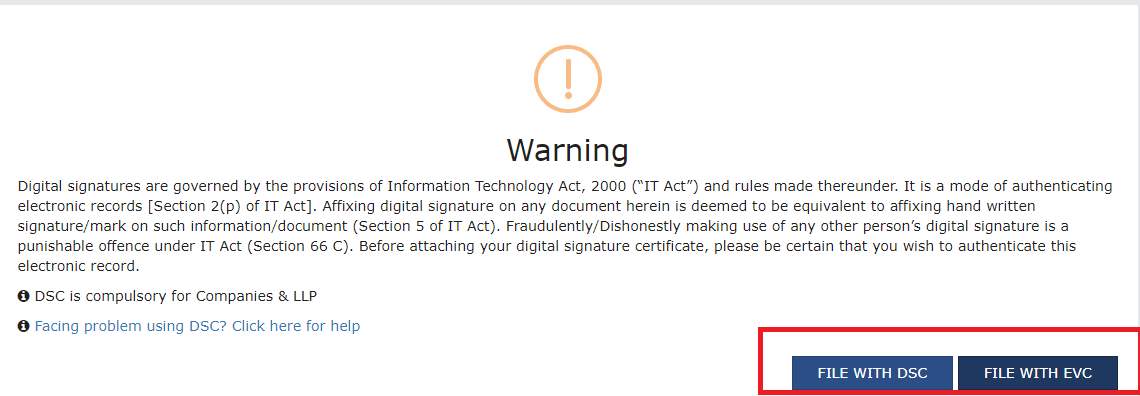

Step 7: The final step is “FILLING” just like a normal GST return, filling via Digital SIgnature or EVC code.

Once the above steps are completed, The TCS amount will reflect in the Electronic Cash Ledger of the registered person.

Frequently Asked Questions on TDS and TCS Credit Received

Under GST, TCS is collected on the net amount of sales made by the eCommerce sellers through the eCommerce operators. The net sales will not include any reverse charge inward supply received by the seller.

Yes, the TCS so collected can be claimed as a refund by the seller via Statement of TCS and TDS filed on the GST portal.

There is not any kind of late fees applicable on filling “TDS and TCS Credit credit received” on the GST portal. Since there is not any time period defined under GST law to claim TCS and TDS refund. There is not any kind of late fees, interest or any other kind of penalty.

Many registered persons are unaware of such TCS collection and TDS deduction. So they usually don’t file “TDS and TCS received”. However, we can file statements for previous periods also and such amount would be transferred to the electronic cash ledger.