Page Contents

How to resolve the issue ‘PAN and Legal name not matching with CBDT database’.

While submitting Part A of GST Reg-01, we often receive an error that PAN and Legal name is not matching with the CBDT database. And the person submitting the application gets perplexed about what’s causing this error. This is a common error and you will find it in the cases of people having names of more than two words.

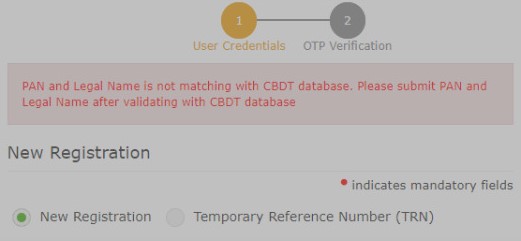

Look at the extract of error. How it appears to us.

Reason for mismatch of PAN and Legal name in CBDT database

Before we directly move on to how to resolve this issue. First, we need to find out the root cause of the error. The issue arises because the name mentioned on the PAN Card is different from the name provided in the CBDT database. How can a name be different you might be wondering?

It’s not different actually the position of words gets interchanged mainly. For example,

A person is having a full name as “Ravi Pal Singh” as shown on the PAN number and the person name as provided in the CBDT database is “Pal Ravi Singh”. A person while submitting GST Reg-01 will enter “Ravi Pal Singh” and the error will come or his or her name is actually different.

Now what he might do? He will move on the Income-tax portal and will find the following error with the PAN number.

The income tax portal would reflect the above. However, there is no reason to fear or think about anything else. Just follow the steps provided below and you will find how to resolve this issue.

Steps: PAN and Legal name not matching with the CBDT database

Just follow the steps and we will find the name as provided in the CBDT database.

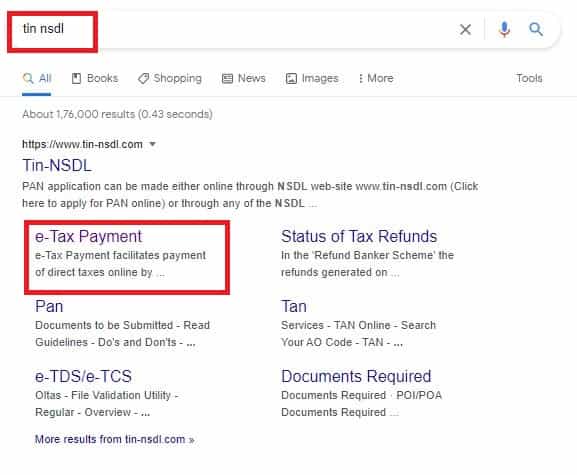

Step 1: Search on Google “TIN NSDL” and then select “e-tax payment” and the TIN-NSDL website would be opened.

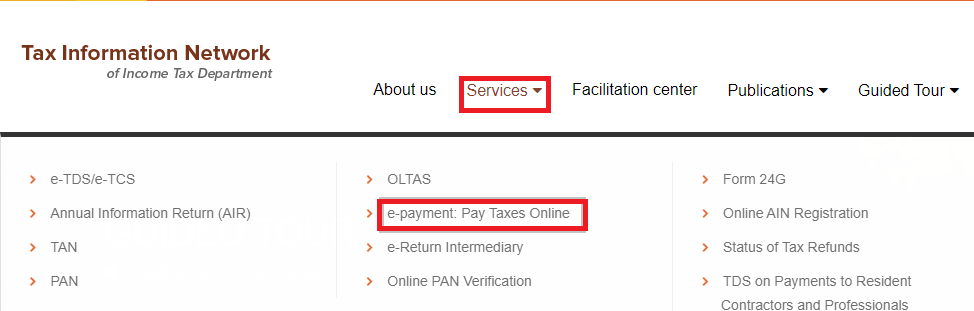

Step 2: The website would appear like this. Even if they change the design, we need to understand what we have to do. In the navigation menu, click on “Services” and then move on to the “E-payment: Pay Taxes Online”.

We are not going to pay the tax, rather reach upon the name saved in the CBDT database.

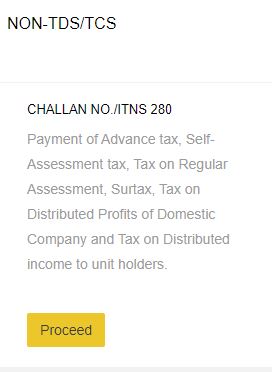

Step 3: Now, there will be many boxes appearing on the screen. You have to Select the Box under Non-TDS/TCS as Challan No/ITNS 280 as shown below.

Once it’s selected a page will appear where we have to enter all the details regarding the tax which we are going to pay. However, we will leave the page once we find out the name without paying the tax.

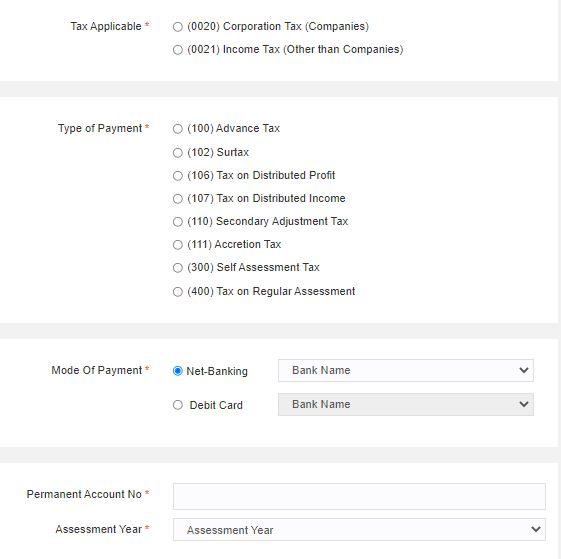

Step 4: Filling all the tax details.

Select:

- Income Tax Other than companies in tax applicable column

- Advance Tax in type of tax

- Choose one mode of payment and enter the bank name

- Enter the PAN Number and select the assessment year, Assessment year should be the next year in which you are currently. Simple, choose the first one.

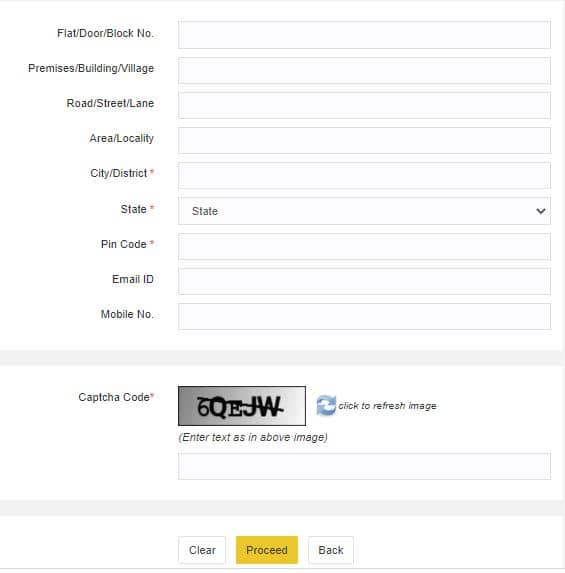

Fill in the address of the assessee and enter the captcha code. Once everything is entered, just click on the Proceed button.

Step 5: Now a payment page will appear, and once you scroll down you will find the name of the assessee written as follows.

(PAX XXVI XXINGH) or (PAL RAVI SINGH) (Read above example first)

The correct position of words. Once you have found out the name, leave the page and don’t complete the payment.

Step 6: Enter the name as you have obtained above in GST REG-01. The error would be resolved. In case you still have a problem then the PAN has been obtained recently, please wait for few days then, until the PAN gets updated in GST Portal.

Frequently Asked Questions on mismatch in name in PAN and CBDT database

No, there is no need to update the PAN card or do any change related to that. Just the assesse should be aware of the position of words in CBDT database

If still, you are facing the issue then, this is because PAN has been obtained recently. Then you should wait for few days before obtaining GST Registration. It will get updated automatically. Otherwise, contact GST Portal Helpline or raise a ticket.