M: +917701879108 E: [email protected]

Page Contents

Letter to supplier for non filling of GST return & Other Alternatives

We will go step by step, first, we will understand the procedure of GST Returns and then draft Reply letter for Non filing of GST Return. Also, we will discuss other alternatives available.

Under the Goods and Service Tax regime, the biggest problem has been transferring of Input Tax Credit to the buyer. In the initial days of GST, there was no mechanism to restrict the claim of GST Credit of the buyer. Although, Section 16 of the CGST Act, provides basic conditions to be satisfied to claim Input Tax Credit.

Read: Four Conditions To Claim Input Tax Credit in GST

However, still many registered persons used to claim Input Tax Credit on the basis of invoice, irrespective of return (GSTR-1) filed by the supplier.

The only party which was at the loss due to this mechanism was Government. The buyer claimed the credit and the supplier failed to file GST returns. Hence, the government didn’t receive payment of the GST portion.

How GST Returns System works? GSTR1, GSTR-2B and GSTR 3B

Before we directly start drafting the letter format for nonfilling of GST Returns. We need to understand how GST Returns works first.

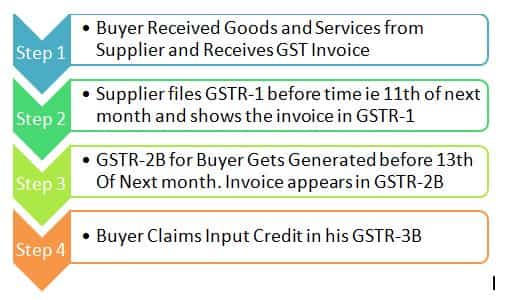

The simple way to understand this complex process is via this Chart.

Decoding the above chart is necessary as there are other points to be understood first.

Step 1: The first step is receipt of goods and services from the supplier and a GST invoice is issued. The GST component on the invoice is Input Tax credit for the buyer if he is a registered person and Section 16 and Section 17 conditions are satisfied.

Read: Blocked Credit in GST Section 17(5)

Step 2: The second step is the most important step, Supplier needs to show the respective invoice in the GST Return that is GSTR-1- GST return for outward supplies. In GSTR-1, the invoice should be shown in the B2B column and the correct GST Number of the buyer needs to be mentioned.

Step 3: The third step is completely dependent upon the second step. The GSTR-2B of the buyer would be generated on the basis of invoices furnished by the suppliers.

Step 4: The final step is auto-population of buyer GST 3B on the basis on the invoices received in GSTR 2B which is completely dependent upon invoices reflected in GSTR-1. So, this is a completely interrelated process.

So, this whole process works in this way. Although, Under Rule 36(4) Provisional ITC up to 5% can be claimed which is not appearing in GSTR-2B. But don’t you think 5% is quite less amount.

Although, Section 43A was inserted with the aim of simplifying the return filling system in GST. However, it has not been implemented yet.

So, what is the next option available to us?

What if Supplier does not pays GST or Files GSTR-1 in time?

After understanding the above procedure, you might be thinking that the claim of ITC by the buyer registered person will largely depend upon the Supplier. If the Supplier failed to file GSTR-1, the Input Tax credit will be blocked.

The first alternative is to communicate to the supplier for non-receiving GST credit in GSTR-2B. The supplier will rectify the mistake next month. However, this monthly GSTR-2A/2B and invoices reconciliation task can be cumbersome and would lead to the excessive payment of tax for the respective month.

Companies that have financed working capital will definitely try to avoid this issue.

The second alternative the buyer will think to stop subsequent payments to the suppliers, in case they don’t file GST Returns. The problem with this method is, most of the suppliers are now under MSME Act and with this action, they can also take benefit of the Insolvency and Bankruptcy Code 2016.

So, we will list down alternatives to be implemented to handle these GST issues.

Measures to be taken for defaulting Suppliers

Avoid Dealing with Defaulting Suppliers: Companies and other registered persons need to develop an internal control system to reconcile the data and extract defaulting suppliers which are causing loss of money and time. First, these suppliers should be asked to be GST Compliant, in case of persistent defaults, they can be replaced.

For this purpose, a letter can be sent to the supplier for non-filling of GST returns.

Supplier Agreement or Indemnification Clause: Prior to making supplies or registering the supplier in company records, a clause can be entered in Supplier Agreement “Further Payments would be stopped” in case of default in filing GST Returns. This would make the supplier self-aware not to commit such mistakes and file GST returns at the proper time.

Holding GST Amount in further Invoices: Now, many companies hold the GST amount and make payment of taxable value in case of further invoices. The defaulting supplier never receives the GST Component and the GST component is paid to the government by the company and later Input tax credit is claimed. The following action should be taken with proper knowledge of GST laws and updates.

Drafting Reply letter for Non filing of GST Return

From Date

Accounts Head/Finance Head

<ABC Private Limited>

Place:

To <Person>

<Defaulting Taxpayer Name>

<Defaulting Taxpayer Address>

Subject: GST Mismatch or GST Credit not appearing in GSTR 2B

Dear Sir,

This is with the reference to the Goods and Service Tax mismatch. We received the following invoices from <Company Name> in the month <October 20> which are attached in the annexure. However, few of them are not appearing in our GSTR-2B for the month of <October>.

The implication of such is to be GST compliant we are not able to claim Input tax credit on such invoices. Please take the corrective action in your respective GSTR-1 in the subsequent month.

Thanks & Regards

Accounts Head

ABC Private Limited