Page Contents

GST Interest calculation, interest on reversal & refunds

How to calculate interest on the late payment of GST?

Interest applies to the late payment of GST. Section 50 of the Central Goods and Service Act 2017 states the following provisions.

(1) Every person who is liable to pay tax in accordance with the provisions of this Act or the rules made thereunder, but fails to pay the tax or any part thereof to the Government within the period prescribed.

He shall for the period for which the tax or any part thereof remains unpaid, pay, on his own, interest at such rate, not exceeding eighteen per cent., as may be notified by the Government on the recommendations of the Council.

Explaining the above provision in laymen’s language. Here every person stands for all the taxpayers who are registered under GST, who are not able to pay GST within the period prescribed are liable to pay tax at the rate of eighteen percent.

GST interest calculation

Take an example, A taxpayer fails to make a payment of Rs. 20,000 GST for January which was payable on 20th February. The taxpayer makes payment on 10th March. Please advise him how interest will be calculated.

Interest will be calculated as follows:

Interest = 20,000*18%*18/365 = 177.53

28 days has been assumed in February

Moving to the next provision of Section 50

(2) The interest under sub-section (1) shall be calculated, in such manner as may be prescribed, from the day succeeding the day on which such tax was due to be paid.

Interest should be paid from the day next to the day on which such tax was due to be paid. The day next to the due date of filing GSTR 3B for a month.

The third provision of Section 50 states that,

A taxable person who makes an undue or excess claim of input tax credit under sub-section (10) of section 42 or undue or excess reduction in output tax liability under sub-section (10) of section 43.

He shall pay interest on such undue or excess claim or on such undue or excess reduction, as the case may be, at such rate not exceeding twenty-four per cent., as may be notified by the Government on the recommendations of the Council.

The above provision states two scenarios, the number one is when the taxpayer claims an excess input tax credit and the second one when the taxpayer claims an excess reduction in output tax liability. An input tax credit can be only claimed for the items which are used for the furtherance of business.

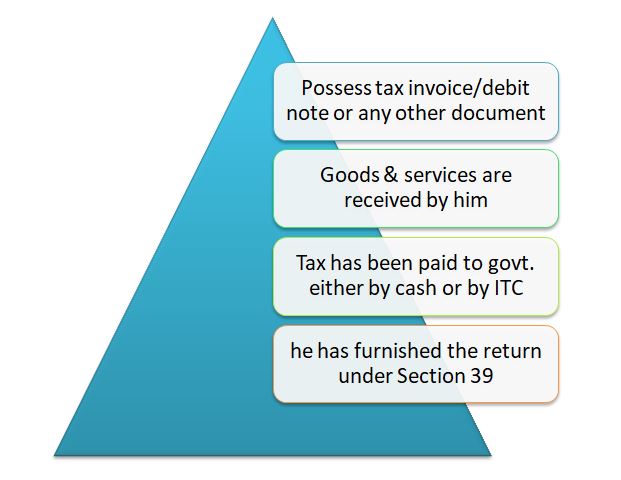

A blocked credit list is also provided under Section 17(5) and eligibility conditions are specified under Section 16. The summary of Section 16 that is the eligibility conditions can be read through this diagram.

GST Interest on ITC reversal

In the case taxpayer claims credit on items specified under Section 17(5) and Section 16 conditions are also not satisfied. It will be considered that the taxpayer has claimed excess credit which would liable to be reversed along with interest at the rate of twenty-four percent.

Hence, it is recommended not to claim any input credit of items specified under the blocked list. Otherwise, at the time of annual returns also, auditors mostly focus on input claimed under the blocked list, which at that time will be reversed along with a substantial interest amount.

GST interest rate

Summarising the above provisions, that would be more compact and clear.

The rate of Interest on GST paid after the due date is 18% and a rate of interest on excess ITC claimed or reduction in output tax is 24%

How interest is paid in GST?

The interest amount is separately charged, GST is not payable on the interest amount. Moreover, the liability of interest is to be paid in cash in separate accounts viz CGST, SGST, IGST. Payment of interest cannot be adjusted with Input credit available in the credit ledger of the taxpayer.

First and foremost at the time of making Challan, check thoroughly how interest is getting paid in separate accounts. There is the chance that interest pertains to IGST while you have made the challan under CGST and SGST.

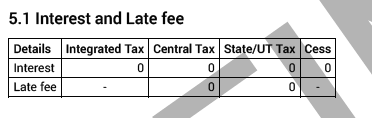

In Table 5.1 of GSTR 3B form, the interest amount can be checked. However, in GSTR -1 interest amount is not to be shown. In case, you have paid interest in IGST, CGST, and SGST the amount will be reflected separately in GSTR 3B.

Interest on GST Refund

Now, taking interest from the government on GST refunds.

When there has been a delay in crediting refund to the registered taxpayer based on GST payments made previously, the government is liable to pay interest on the refund amount outstanding at 6% per annum along with the refund itself.

The applicability of the GST refund is governed by Section 54 (section 12) and Section 56 of the GST Act, 2017. A higher interest rate on GST refunds at 9% is payable by the government under Section 56 if a delayed refund is issued as a result of an order from an applicable appellate authority

Connect with us at +917701879108 and gstmentor1@gmail.com