Page Contents

How to respond to scrutiny notice GST ASMT-10?

GST ASMT-10 ( Assessment Notice) is issued under Section 61 of the CGST Act read along with Rule Number 99. The assessment notice is issued when there is a discrepancy in the GST Returns filed (GSTR-1 and GST-3B), tax paid in GST -3B is less than the tax payable on outward supplies in GSTR-1, and other Input tax credit discrepancies which we will discuss further.

Section 61 and Rule 99 of the CGST Act

Before we directly jump upon how to file a response to GST ASMT-10, we need to understand the laws and provisions governing ASMT-10.

Section 61- Scrutiny of GST returns, which states the following.

- The proper officer may scrutinize the return and related particulars furnished by the registered person to verify the correctness of the return and inform him of the discrepancies noticed, if any, in such manner as may be prescribed and seek his explanation thereto.

- In case the explanation is found acceptable, the registered person shall be informed accordingly and no further action shall be taken in this regard.

- In case no satisfactory explanation is furnished within a period of thirty days of being informed by the proper officer or such further period as may be permitted by him or where the registered person, after accepting the discrepancies, fails to take the corrective measure in his return for the month in which the discrepancy is accepted the proper officer may initiate appropriate action including those under section 65 or section 66 or section 67, or proceed to determine the tax and other dues under section 73 or section 74.

Now, summarising the above, the GST officer can send a notice in the form of ASMT-10 if he believes there is a discrepancy in GST Returns filed which can be related to Tax payable in GSTR-1 or GST-3B, Input Tax Credit eligibility, or any other data as furnishes in the returns.

The registered person needs to file the response and in case the response is accepted by the GST official, the scrutiny will be closed.

Now, if the registered person didn’t take any action, does not file any response to the notice in GST ASMT-11, or fails to pay the tax or reverse input credit, the GST official can take further actions under the following sections.

Section 65 – Audit by Tax Authorities

Section 66 – Special Audit

Section 67 – Power of Inspection, Search, and Seizure

Section 73 – Determination of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilized for any reason other than fraud or any wilful-misstatement or suppression of facts

Section 74 – Determination of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilized by reason of fraud or any wilful misstatement or suppression of facts.

Still, now we have understood Section 61, now let’s add Rule number 99 and judicial provisions.

Rule 99(1) provides that GST Officer has to seek an explanation for the discrepancy in the form ASMT-10 within such time but not exceeding 30 days of service of notice. “Service of Notice” will mean when the registered person receives the notice not when the notice is issued, as according to Section 61 and under the light of V.R.A Cotton Mills Case.

Rule 99(2) provides that the reply against GST ASMT-10 will be filed under GST ASMT-11 and Rule 99(3) provides that GST Officer shall inform the registered person in GST ASMT-12 if the reply submitted is acceptable.

Moving forward to the practical implications of the above provisions.

Reasons for which GST ASMT-10 can be issued

Understanding the reasons for which GST ASMT-10 can be issued will help us to prepare the response. The first and foremost reason tax payable as per Outward supplies shown in GSTR-1 vice tax paid in GSTR-3B. In case the tax paid is less than the actual tax liability. GST ASMT-10 can be issued.

The second reason can be the difference between Input Tax Credit appearing in GSTR-2B and with GST Credit availed in GSTR-3B. Any excess claim would amount to the issue of notice. Excess should be reversed along with Interest at 24%.

The third reason can be tax liability shown in E-way Bills and tax paid in GSTR-3B. Section 61 clearly stipulates that the officer can use the data available with him.

It’s better to reconcile the data every month or on a quarterly basis. The large volume of transactions will often lead to differences, no matter what you do. It’s better to prepare monthly reconciliations so that any adjustment can be made in subsequent months.

Procedure to handle GST ASMT 10

There can be two cases when GST ASMT 10 is issued.

i) Taxpayer agrees with the discrepancies mentioned in ASMT-10

If the taxpayer agrees with the discrepancies mentioned in the ASMT-10, the taxpayer should pay the tax along with interest and penalty. File form ASMT-11 and accept the discrepancies, pay the tax and make adjustments in GST Returns.

ii) Taxpayer does not agree with the discrepancies mentioned in ASMT-10

Now, if the taxpayer believes that he has rightly paid the tax and availed of eligible credit. A taxpayer can file a response to the GST officer in GST ASMT-11 along with supporting documents. The supporting documents can include reconciliations between the returns and other eligible documents to prove to the officer. Preparing proper workings and then challenging the officer.

How to download the scrutiny notice GST ASMT-10?

Step 1: The first step is to login into the GST portal.

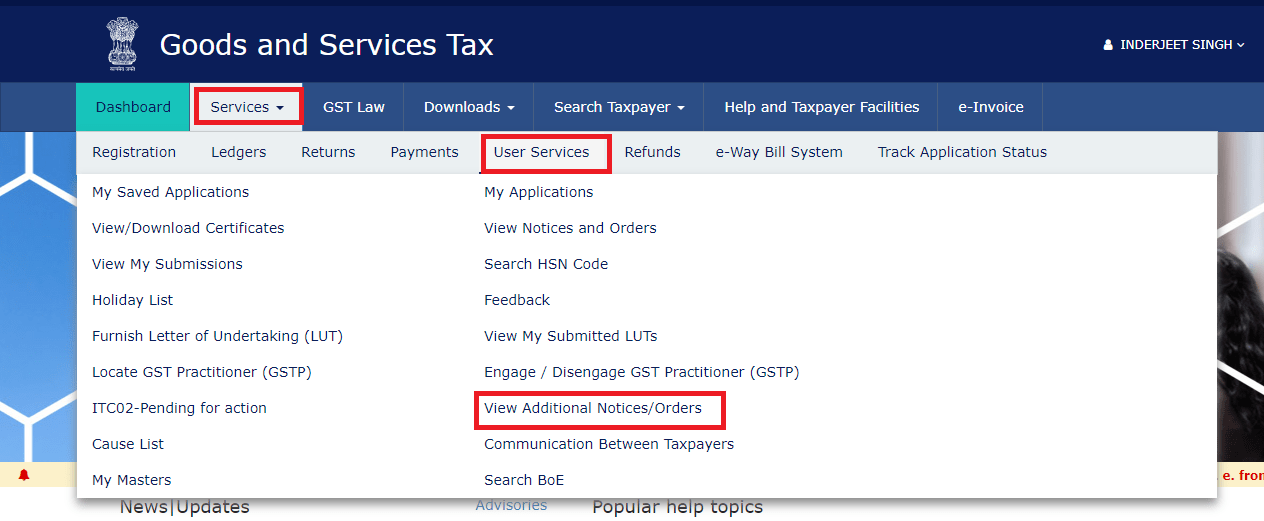

Step 2: Go to the Services tab in the navigation menu and move to User Services> View Additional Notices and Orders.

Step 3: Then details of the notice would appear & in the right column of the page There will be an option to “View” notice. Click on View notice.

Step 4: A notice will be attached to the page. The filename would be the notice number and then click on the link of the notice. The notice would be downloaded on your computer.

How to respond to the notice in GST ASMT-11?

After downloading the notice, one needs to file the response whether the taxpayer accepts or rejects the objection. A response should always be filed for show-cause notice to avoid further proceedings.

After examining the query and the quantum of liability raised in the notice. One should verify it with the returns filed (GSTR-1 and GST-3B), Prepare reconciliation with accounting records, and look for adjustments made in GSTR-9 which can be neglected also.

Then move forwards to preparing a draft response along with the supporting documents and annexures to prove the accuracy of the same. Once all the documents are ready, we can file ASMT-11

The steps to file a response to a scrutiny notice are as follows.

Step 1: In step 4 of downloading, when we were downloading the notice, on the left-hand side, there was an option of “Replies”. Click on Replies> Add Replies> Notice for which reply is filed.

Step 2: The details of the notice would appear along with the date of notice and reference number. There would be a field to file responses. The details of tax liability admitted or accepted by the taxpayer along with interest would be mentioned. Just below it, an option to attach the supporting documents would be provided.

Step 3: Once you fill in the details and amount admitted. Move to the verification tab, and enter your name and place.

Step 4: Wait! Don’t file click on the “Preview button” and once again check all the details.

Step 5: File the response with EVC code or with DSC

The replies tab will be updated and the status would be “Reply furnished and pending with tax officer”.

How to check the order under GST ASMT-12?

We are moving line by line, first, we went to the Notices tab to download the notice, then the Replies tab to file a response, and now we will move forward to the “Orders” tab and then again click on the attachment tab to check the order.

The limit for officers to respond is not mentioned. So, there’s not any time limit.

If the officer is satisfied he will issue GST ASMT-12 and drop the proceedings of the case. This means our response has been accepted by the GST official.

In case, the officer does not accept the response filed. He will pass an order demanding the tax liability along with interest and penalty.

GST ASMT-10 reply letter format in word

To

Name of officer

Designation of officer

Office address

Subject – Response to the notice received under Form GST ASMT-10 dated dd-mm-yy

Dear Sir,

I Name of authorized signatory, Designation of M/s Trade Name/Name of Firm having GSTIN – XX located at XXX (Principal place of business) would like to submit my response to notice no. XX received on XX.

- Write the main reason for the issuance of notice along with the difference in amount.

- On our reconciliation, we noted such difference was on account of ‘Reason’. Explain the reason in detail and give reference to the relevant annexure.

- Conclude either by rejecting the demand or accepting the demand.

Sign of authorized signatory

Name of authorized signatory

Download the format for the GST ASMT-10 reply letter

Connect with us at +917701879108 and gstmentor1@gmail.com