Page Contents

How to check GST Registration status on GST portal?

In this article, we have discussed how to check GST registration status using ARN and SRN numbers on the GST portal and understanding the statuses reflected after tracking the number.

What is ARN? ARN Full form in GST

After filling Part A & Part B of GST REG-1 (GST Application form). The tax official needs time to verify the details filled in the application form. Since it requires time for verification of details, a unique reference number is provided to the taxpayer. This unique reference number is known as the ARN or Application Reference Number. Through the ARN status of the GST application form can be checked on the GST portal.

Check GST Registration Status via ARN number

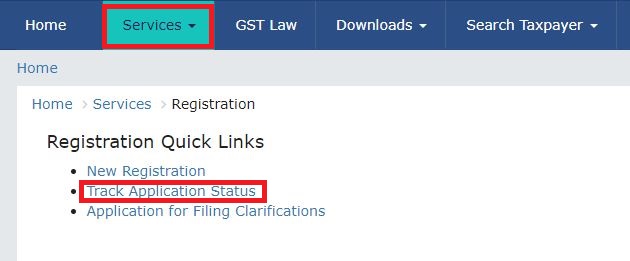

- The first step is to access the home page of the GST portal at www.gst.gov.in

- The second step is to click on the “Services” tab on the top bar

- After clicking on the Services tab, now click on “Track Application Status”

- The next involves entering the ARN number and pressing the “Search” button.

After entering the ARN Number, a table will appear which will reflect the following details.

- Your ARN number

- Form Number

- Form Description

- Submission date

- Status

What are the types of Application Reference Number (ARN) status?

The following status of the ARN number can appear after clicking on the search button.

- Provisional

Provisional registration is a temporary registration that will become permanent only after fulfilling certain conditions. The state departments provided new taxpayers with Provisional IDs and passwords. A taxpayer needs to enroll with these provisional IDs in the GST portal.

- Pending for verification

It simply means that the application form has been filed successfully. However, it needs to be verified by the GST officer.

- Validation against error

This issue arises due to the incorrect Permanent Account Number (PAN number) furnished by the taxpayer. PAN number is not matching with the CBDT database. The issue gets resolved once the taxpayer resubmits the form with the correct PAN details.

- Migrated

Migration is the process of issuing a Provisional GSTIN in the Form GST REG-25. The Migrated status means that the application has been successfully migrated under GST and no further changes can be made to the application now.

- Canceled

The application has been rejected by the GST officer due to any incorrect details provided by the taxpayer. Most of the time applications are rejected due to issues in documents relating to the Principal place of business.

The taxpayer needs to apply again with correct particulars using the application FORM GST REG-1.

- Application approved

The application filed for obtaining GST registration has been approved by the GST officer after verification of details provided by the taxpayer. A Certificate of Registration is granted to the taxpayer and he needs to create a username and password for the first login.

What is SRN? Full form of SRN In GST?

A service request number is generated when a taxpayer applies for GST Registration while applying for the incorporation of a company on the MCA portal. The application is made through a SPICE AGILE (INC-35) form. When the application is submitted a unique reference number is generated know as Service Request Number (SRN).

Check GST Registration Status using the SRN number

The GST Registration status can be checked via a Service Request Number (SRN) by following the same steps. However, in the case of the ARN number, Select the SRN number and enter the SRN number, and then on the “Search” button.

Status of SRN number on GST portal

The status of the Service request button number can be as follows.

- Pending with MCA (Ministry of Corporate Affairs)

SRN is generated by the MCA but the form has not been sent to the GST portal to obtain the GST number.

- COI (Certificate of Incorporation) issued by the MCA and TRN (Temporary Reference Number) is generated

This means that the information has been received from the MCA portal to the GST portal but the application for GST has not been completed. Generation of TRN number indicates Part A of GST REG-01 has been filed.

- COI (Certificate of Incorporation) issued by the MCA and Pending for processing by GST portal

The following status means an application for GST registration has been complete and submitted. The ARN number has been issued and sent to the taxpayer.

- COI (Certificate of Incorporation) issued by the MCA and Approved by the GST portal

Application for GST registration has been approved by the GST officer and GSTIN is sent to the taxpayer via SMS and Email.

- COI (Certificate of Incorporation) issued by the MCA and Rejected by the GST portal

The GST application (GST REG-01) was filled but has been rejected by the GST officer. The application needs to be resubmitted with correct particulars directly on the common portal.

Frequently asked questions on GST registration application tracking

In case show cause notice has been issued and a clarification is filed. Then you should track your GST registration to see the status of application. Otherwise in GST applicant is informed in three days in case of any deficiency in the application.

It means GST Reg-01, GST Application form has been accepted. The person is registered in GST and he might have received GST Login credentials for making the first login on the registered email address.