Page Contents

Conditions for eligibility of GST Tax credit under Section 16

GST Input tax credit has been further classified into Eligible and Blocked Credits. Blocked Credits are dealt with under Section 17(5) while Section 16 deals with GST Input tax credit eligibility and conditions.

Before we proceed onto Blocked and Eligible credit, let us first understand some important definitions provided under the CGST act.

Why government launched GST and changed the entire tax regime?

In the previous tax regime, there was nonavailability of credit at various points in the supply chain, leading to the cascading effect of tax i.e. tax on tax.

This increased the cost of goods and services.

The flaw has been removed under GST as there is a continuous flow of credit from one person to another in the value chain. “Produce goods or services, pay output tax and adjust input tax”

What is an Input tax credit?

The meaning of ‘Input Tax’ and ‘Input Tax Credit’ is defined under Section 2(62) and Section 2(63) of the CGST act.

Section 2(62) of the CGST Act

“Input tax” in relation to a registered person, means the central tax, State tax, integrated tax, or Union territory tax charged on any supply of goods or services or both made to him and includes-

(a) the integrated goods and services tax charged on import of goods;

(b) the tax payable under the provisions of sub-sections (3) and (4) of section 9;

(c) the tax payable under the provisions of sub-sections (3) and (4) of section 5 of the Integrated Goods and Services Tax Act;

(d) the tax payable under the provisions of sub-sections (3) and (4) of section 9 of the respective State Goods and Services Tax Act; or

(e) the tax payable under the provisions of sub-sections (3) and (4) of section 7 of the Union Territory Goods and Services Tax Act,

but does not include the tax paid under the composition levy.

Section 2(63) of the CGST Act

“Input Tax Credit” means the credit of input tax.

For Example

Suppose there are three companies namely ‘A’, ‘B’,’ C’ dealing in any manufacturing activity.

A produced the goods and sold them to B for Rs 100 + Rs. 18 as GST.

B also added value to those goods and sold them to C for Rs 150+ Rs. 27 as GST.

Now C reworked upon those goods and sold final goods to the ultimate customer for Rs. 200 + Rs 36 as GST.

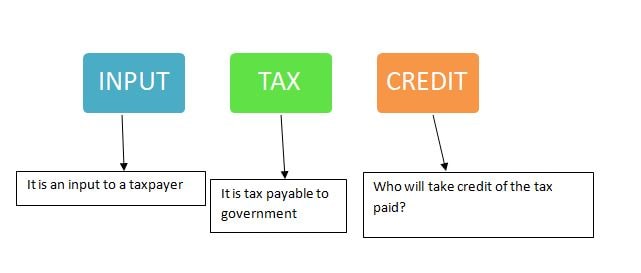

To understand what is Input Tax Credit? Let’s break this word.

In the above example,

Goods were sold by A to B for Rs. 100+ Rs 18 as GST. For B those goods are an input to produce an output and the tax levied on the transaction is also input. B will liable to take credit of Rs. 18 as he used the goods for further production.

Similarly, B sold the goods to C for Rs 150 +Rs 27 as GST. For C those goods are an input to produce and output and the tax levied on that transaction is also input. C will take credit of Rs 27 as he used goods for rework.

Ultimately, goods were sold to the Customer by C for Rs 200 + Rs 36 as GST. This is the final price of goods and tax was borne by the customer.

GST Input Tax Credit Under Section 16- Eligibility and conditions

Every registered person, subject to the conditions specified in Section 49 of GST Act is entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to use in the course or furtherance of business and the said amount shall be credited to the electronic credit ledger of such person.

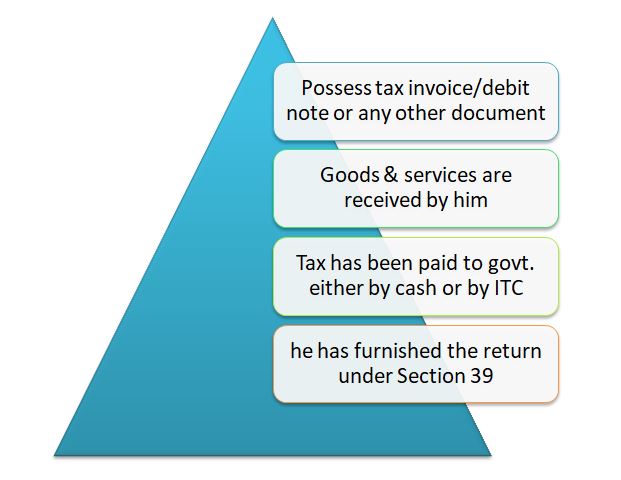

No person shall be entitled to take the credit of any input tax in respect of any supply of goods or services or both to him unless:

The four conditions are satisfied.

- He is in possession of tax invoice/debit note issued by the supplier registered under this act or such other taxpaying documents as may be prescribed.

- Subject to the provisions of Section 41, the tax charged in respect of such supply of goods and services is paid to the government either by cash or utilizing ITC

- The taxpayer has furnished the return under Section 39.

- He has received the goods and services or both.

Now, What if goods and services are received on behalf of him by someone else?

For this purpose, it will be considered that the registered person has received the goods. When delivered by the supplier to the agent on direction of such registered person. Before or during movement of goods, by way of transfer of documents of title to goods

FAQ on ITC (Input Tax Credit)

When the taxpayer will furnish the GST return, he will add the details of Purchases made during the month and all details of tax levied on the transaction. The credit would be taken in FORM GSTR 3B.

An input tax credit cannot be claimed for items mentioned in Section 17(5) of the GST Act. All of the ineligible credits are listed in Section 17(5) Of the CGST act. Also, the purchases made should be made for the furtherance of business.

Yes, the conditions are listed in Section 16 of the CGST Act.

When goods and services are received in lots or installments, the registered person shall be entitled to take credit upon receipt of the last lot and installment.

For example

Mr. A orders 300 tonnes of goods from Mr. B which are to deliver in three lots of 100 tonnes each. The lots are sent under a single invoice with the first lot and payment is made by the recipient for the value of supply plus GST and the supplier has also deposited the tax with the government.

The three lots are supplied in May June and July 2018.

The ITC is available to Mr. A only after receipt of the third lot that is in July 2018.

Where the registered person has claimed depreciation on the tax component of the cost of capital goods and plant and machinery under the provisions of Income-tax act, 1961. The input tax credit on the said tax component will not be allowed.

A registered person shall not be entitled to take Input Tax credit in respect of any invoice or debit note for the supply of goods or services or both after

- Furnishing of the relevant annual return( GSTR-9)

- Due date of furnishing of the return under Section 39 for the month of September following the end of the financial year to which such invoice or invoice relating to such debit pertains

Whichever is earlier.

When the recipient fails to pay to the supplier of goods and services or both, other than the supplies on which tax is payable on a reverse charge basis, the amount towards the value of supply along with the tax payable thereon within a period of 180 days from the date of issue of invoice by the supplier.

An amount equal to the input tax credit availed by the recipient shall be added to his output tax liability along with the interest thereon.