What is the Casual Taxable Person registration procedure in GST?

A casual taxable person registration procedure involves filling out FORM GST REG-01 explained below. Before we move on to the procedure lets, first understand some basic terms.

Who is a Casual Taxable Person or a casual dealer/trader?

- A casual taxable person is a person who occasionally undertakes transactions involving the supply of goods and services.

- The transaction is taken in the course of the furtherance of business whether a principal, an agent, or in any other way.

- The transaction should take place in a state or union territory where he has no fixed place of business.

Before we move on to the example of the casual taxable person, what is a definition of a “person” in GST,

A person includes

- Individuals

- Companies (Private or Public)

- Hindu Undivided Family (HUF)

- Partnership Firm

- Limited Liability Partnership (LLP)

- Any Government company or corporation

- Co-operative Societies

- Body of Individuals (BOI) or Association of Person (AOP)

- Any local authority or trust

Example of Casual Taxable Person

Mr. A has a business in Gurgaon and is registered in Haryana. Mr. A went to Delhi for an exhibition and sold goods there. This is an occasional transaction, not an ordinary transaction. Mr. A also does not have a fixed place of business in Delhi. So, Mr. A is a casual taxable person and will be required to obtain a temporary registration for Delhi.

Casual Taxable Person Registration Procedure

- Compulsory Registration

A casual taxable person compulsorily needs to take registration in GST without any threshold limit. The limit of Rs. 20 lacs and Rs. 10 lacs for special category states does not apply to the casual taxable person.

- No benefit of the composition scheme

A casual taxable person cannot pay tax under the composition scheme.

- The time period for taking registration

A casual taxable person needs to take registration at least five days before commencing his business.

- The advance deposit of tax

A casual taxable person has to make an advance deposit of tax in an amount equivalent to his estimated tax liability for the period for which the registration is sought.

For example, Mr. A undertakes a taxable supply of Rs. 1,00,000 then he needs to deposit 18% of 1,00,000 that is Rs. 18,000. (Tax rate assumed to be 18%)

How to register a Casual Taxable Person under GST?

A casual taxable person is registered just like a normal taxable person using the Form GST REG-01.

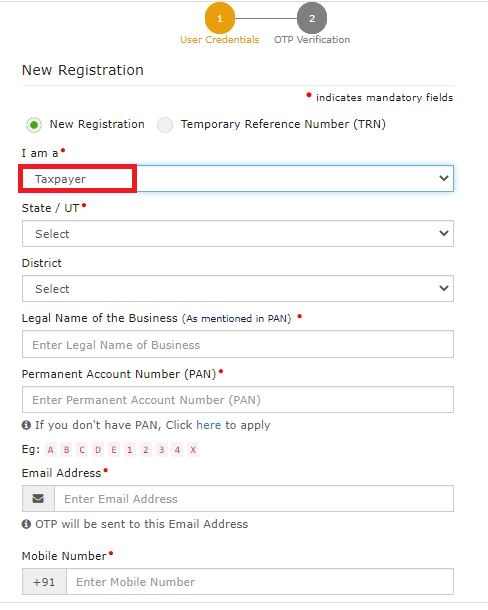

- In Part A of GST REG-01, select I am “Taxpayer”(Highlighted in red in the above image). Declare your state, district, legal name of the business, Permanent Account Number, and Email address/Mobile Number on which OTP will be sent.

- After filling Part A and on successful OTP verification a Temporary reference number will be generated. Using this reference number Part B of GST REG-01 will be filled.

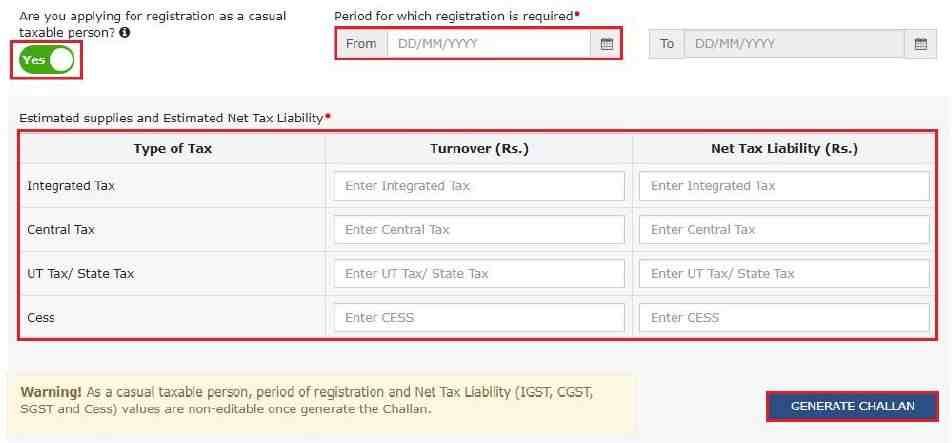

- In Part B of the form, turn on Are you a Casual taxable person? to Yes.

- Enter the time period for which you want to take registration.

- Pay the tax liability as an advance in respective IGST/CGST/SGST heads and also specify taxable turnover.

- An acknowledgment for the same will be generated in GST REG-02.

After paying the liability certificate of registration will be granted by the proper officer. The certificate of registration will be valid for ninety days or the time period specified in Part B whichever is earlier. The casual taxable person can only undertake supplies of goods after granting of a certificate of registration.

Can the time period for the Certificate of Registration for a casual taxable person be extended?

The extension for a certificate of registration for a casual taxable person can be done for a maximum of ninety days. The application shall be made in GST REG-11. The application should be made before the expiry of the first ninety days granted.

Also, additional tax liability arising out of further taxable supplies in the next ninety days should be deposited.

How to fill GST REG-11 (Extension form) for Casual Taxable Person?

The form GST REG-11 can be submitted electronically on the common portal or either directly or through a Facilitation Centre notified by the Commissioner.

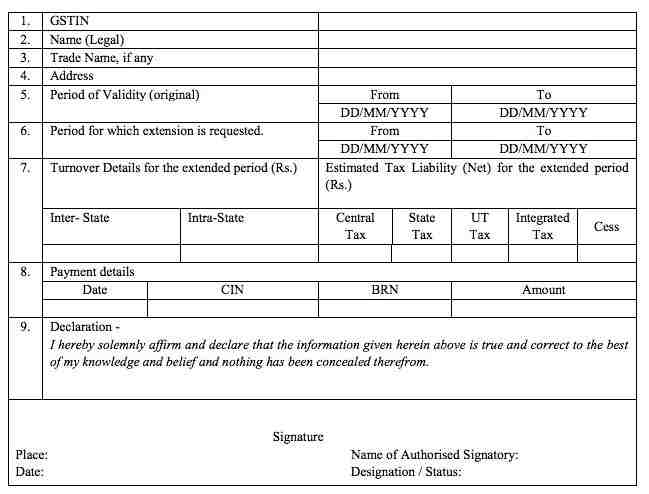

- Fill in GSTIN/Name /Trade Name and the address in GST REG-11.

- The original period for which registration was taken shall be entered and the time period for which extension is sought.

- Enter the Turnover details and the tax liability arising out of such extension bifurcated into Central GST, State GST, Integrated GST, and Cess.

- And finally, payment should be made.

GST returns for Casual Taxable person

The casual taxable person needs to fill the following returns electronically through the GST portal.

- Form GSTR-1 providing the details of outward supplies of goods and services to be filed on or before the tenth of the next month. (ACTIVE)

- Form GSTR-2 providing the details of inward supplies to be filed after the tenth but before the fifteenth day of the following month. (NOT ACTIVE)

- Form GSTR-3 to be filed after the fifteenth day but before the twentieth day of the following month. (NOT ACTIVE)

- Form GSTR-3B to be filed to claim Input tax credit filed before 20th or 24th in some states. (ACTIVE)

However, currently, only GSTR-1 and GSTR 3B needs to be filled. Similarly, GST annual return (GSTR-9) is not required to be filled for a casual taxable person.

Refund for Casual Taxable person

In case if there is an excess amount available after adjusting the advance tax with liability. The excess can be taken as a refund. The returns need to be furnished for the time period certificate of registration was valid. The refund of the amount in the cash ledger has to be made in Serial No. 14 of Form GSTR-3.

FAQ on Casual Taxable Person

A CTP needs to pay the amount of tax liability arising on the occasional supply of goods and services in a concerned state in advance. The payment is made through a GST challan while filling GST REG-01.

In this scenario, the taxpayer needs to take normal registration for that particular state.

The casual taxable person can apply for multiple registrations within one state.

A casual taxable person can avail Input tax credit of goods and services in Form GSTR-3B.

No, the amount of tax liability arising out of taxable supply needs to be deposited. No need to pay any fixed amount.