Page Contents

How to handle GSTR-3A- Notice for defaulters of GST Return filing

GSTR-3A is a format of notice received for not filing a return under Section 39 of the CGST Act. It is not any kind of return forms like GSTR-1 or GST-3B where information needs to be added.

GSTR-3A is a system-generated notice sent by the common portal issued to the taxpayers who fail to file GST Returns.

When GSTR 3A Notice is issued under Section 46

GSTR-3A notice is issued under Section 46 of the CGST Act if you might have received it. You would have seen it, the heading is mentioned as “Notice to Return Defaulter Under Section 46 for not filing return”

Moving towards Section 46 of CGST Act, 2017. Section 46 states Where a registered person fails to furnish a return under section 39 or section 44 or section 45, a notice shall be issued requiring him to furnish such return within fifteen days in such form and manner as may be prescribed.

Section 39 states that every registered person shall file GST Returns and the return referred to in this section is GSTR-3B. So for not filing GST-3B, GSTR-3A can be issued.

For special category persons, Composition Dealer (GSTR-4), Non-Resident (GSTR-5), Input Service Distributor (GSTR-6), GSTR-7 (Persons liable to deduct TDS), GSTR-8 (Persons liable to deduct TCS). For them also, GSTR-3A can be issued.

Section 44 states that every person liable to file an annual return shall file an annual return. So, GSTR-3A can be issued for not filing GSTR-9.

Section 45 states that every registered person who is required to furnish a return under sub-section (1) of section 39 and whose registration has been canceled shall furnish a final return within three months of the date of cancellation or date of order of cancellation, whichever is later, in such form and manner as may be prescribed. So, GSTR-3A can be issued for GSTR-10 also.

How to download GSTR-3A Notice from GST Portal?

The registered person would have received an email and text message on the registered email stating a notice has been issued for not filing GST Returns.

Afterward, a user should log in to the GST Portal.

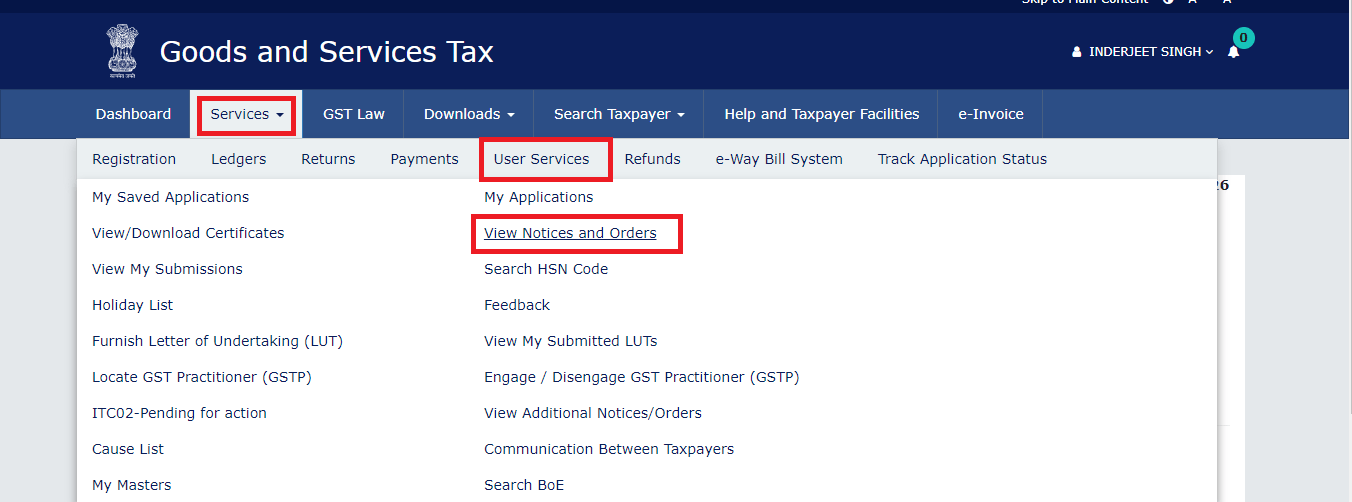

Step 1: Go to the Services Tab> User Services > View Notices and Orders

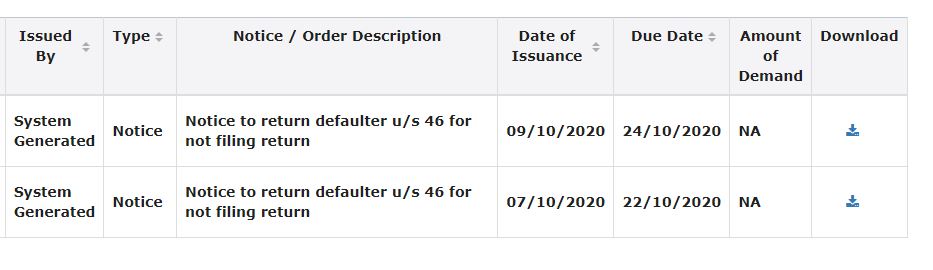

Step 2 The number of notices issued under section 46 for not filing GST Returns will display there. See the Notice is system generated. Now click on the download button to view the notice and the notice would be downloaded.

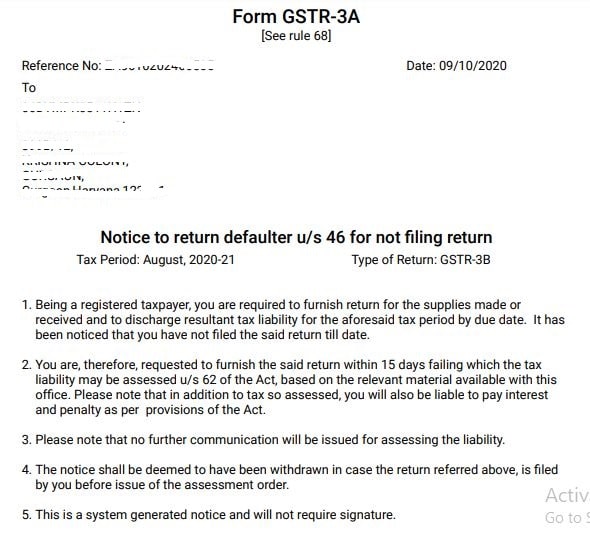

GSTR-3A Notice in PDF Format

GSTR-3A notice will be downloaded in PDF format and will appear like this.

How to handle GSTR-3A Notice?

The registered person should file the returns applicable along with interest and penalty. The returns need to be filed within 15 days of receiving the notice. Returns can be accepted after 15 days also, but before the order under section 62 has been passed.

Many of the registered taxpayers in India forget to file GST Returns after obtaining GST Registration and end up paying penalties and late fees. To save late fees on GST Returns. Contact Us. GST portal will itself calculate late fees applicable, once you file the GST Return. Returns cannot be filed unless the amount of late fees is deposited for NIl returns.

Get GST Returns filed by an expert

Also, in case the registered users have not shown outward supplies in GSTR-1 and have not paid the tax in GST-3B. Then, interest at 18% shall also be levied in addition to the tax amount.

The time period of interest will be from the next day of the due date of filing GST Returns to the date of payment.

What if GST Returns are not filed after the GSTR-3A time limit expiry?

In case the registered person has not filed returns mentioned under Section 39, Section 45, Section 46 as discussed above even after issuing of notice under Section 46 (GSTR-3A Notice). The GST Officer will be entitled to take action under Section 62 that is “Best Judgement Assessment” on the basis of materials available with him.

Frequently Asked Questions on GSTR-3A

GSTR-3B is the return while GSTR-3A is the notice received under Section 46 of the CGST Act. GSTR-3B return needs to be filed monthly or on a quarterly basis while GSTR-3A is issued to the registered taxpayer for not filing GSTR-3B and other returns.

The registered taxpayer needs to file GST Returns along with interest and penalty within 15 days of issue of notice. Non-filling returns will attract the provisions of Section 62 which is Best Judgement Assessment.

First, log in to the GST portal and then Go to the Services Tab> User Services > View Notices and Orders. There you will find the list of notices issued to you under Section 46. Click on the download button and the GSTR-3A will be downloaded in PDF format.