Page Contents

Letter of Authorization for GST Registration

While registering for GST, we need to add information about the authorized signatory. However, in the case of a proprietorship, it is not necessary to appoint another authorized signatory. Proprietor himself can act as an Authorized Signatory.

In GST Reg-01, in the column of “Authorized Signatory” at the top of the page, you will find the option to select Promotor as “Authorized Signatory in case of proprietorship. Look into the image below.

Once selected all details will automatically be filled in. A letter of authorization for GST registration is required to appoint a signatory. Before moving on to the Letter of Authorization. First, we need to understand some basic terms.

Who is an Authorized Signatory in GST?

An Authorized Signatory is a representative with the power to sign an agreement, file GST returns by attaching a Digital Signature, and reply to notices and queries of the GST department unless otherwise specified.

What is a Letter of Authorization in GST?

Written confirmation of a person’s rank, authority, and ability to enter into a legally binding contract, take a specific action, spend a specified sum, or delegate his power and duties.

Where a Letter of Authorization is attached?

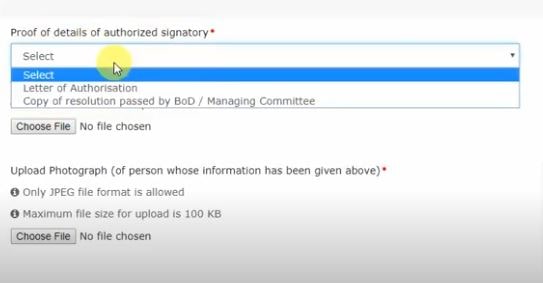

While registering for GST, there is an option to Appoint an Authorized Signatory. After filling in the personal details like Name, PAN, and other details. The form asks for an attachment of the Board Resolution for Authorized Signatory in case of companies and a Letter of Authorization in case of Proprietorship/Partnership.

Even after registration is granted one can appoint another authorized signatory. The authorization letter shall be made separate for all authorized signatories.

It’s better to use Board Resolution for companies, while all other entities can attach Authorization Letter.

Format of Letter of Authorization in PDF and Word Format

Declaration for Authorized Signatory

I/We (Name of Proprietor/all Partners/Karta) hereby solemnly affirm and declare that (name of authorized signatory) to act as an authorized signatory for the business (Name of the Business) having GST Registration Number (Number) for which application for registration is being filed/ is registered under the Goods and Services Tax.

All his/her actions in relation to this business will be binding on me/us.

Signature of Proprietor/All Partners

Name

Designation

Acceptance as an authorized signatory

I (Name of authorized signatory) hereby solemnly accord my acceptance to act as authorized signatory for the above-referred business and all my acts shall be binding on the business.

Signature of Authorized Signatory

Designation/Status

Place

Date

You can download the letter of authorization for GST registration and edit it as per your own terms.

Frequently Asked Questions

In GST, Letter of Authorization should be signed by both the parties. One who is getting appointed as Authorized Signatory and the Other One should be Promoter/Partner who has the power to appoint.

It is mandatory when we are appointing the authorized signatory. However, if the proprietor himself is the authorized signatory, then we can select him as the authorized signatory. Then there would not be any requirement to attach an authorization letter.

An authorized signatory can be added later on also after obtaining GST registration by submitting a form on the GST portal.